|

A $37 Trillion Currency Reset Just Started

|

|

The US government has a problem.

For decades, the status of the US dollar as a global reserve currency has given the United States tremendous privilege.

It's allowed the government to finance its massive debt pile at very low interest rates and run persistent trade and fiscal deficits with very little consequence so far.

But this privilege is showing signs of disappearing. |

|

|

|

|

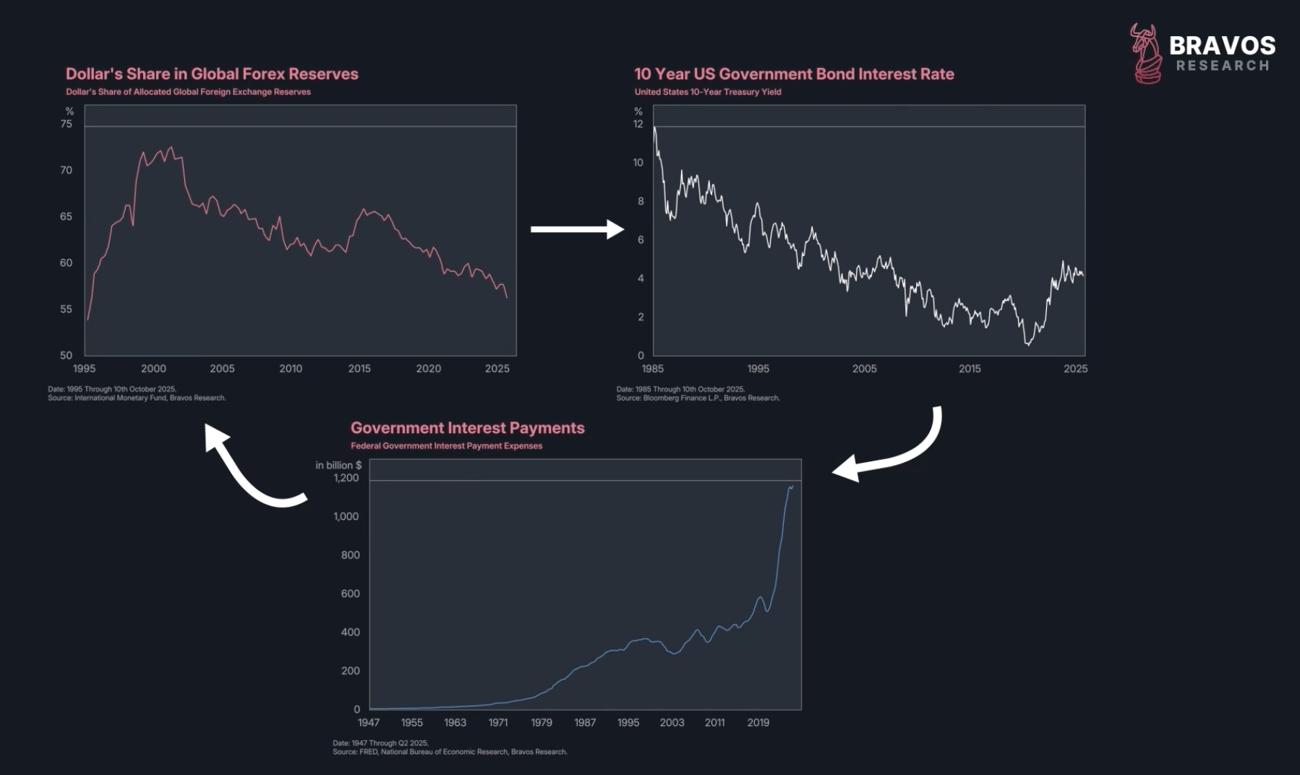

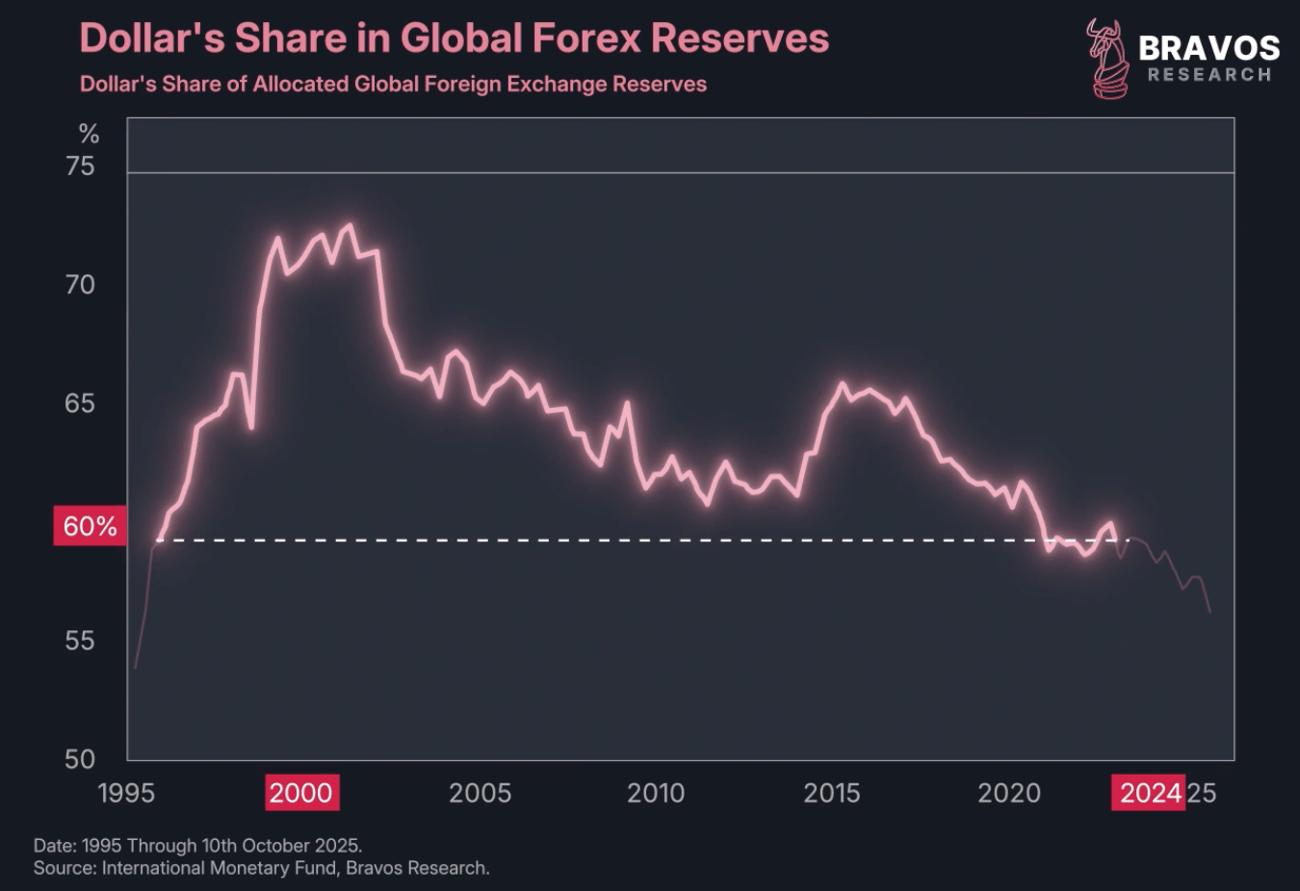

The US dollar's share of foreign exchange reserves has just hit the lowest level in 30 years.

The US government's interest rates are now hovering at around the highest levels of the last 20 years, breaking out of what had been until very recently an extremely steady downtrend.

As a result, we've seen the government's interest payments on debt go from $500 million to $1.2 billion in just 5 years.

Interest payments alone are now equivalent to over a 1/5th of total government revenues.

This is a phenomenon the European Central Bank has labeled as the "debt doom loop." |

|

|

This loop is where loss of confidence in national debt leads to higher interest rates, which leads to budget problems, which further impacts investor confidence in the debt.

But the US government believes it has a solution to this problem:

A cryptocurrency reset that could completely stop this phenomenon and potentially even reverse it. |

|

|

Understanding Government Interest Rates |

|

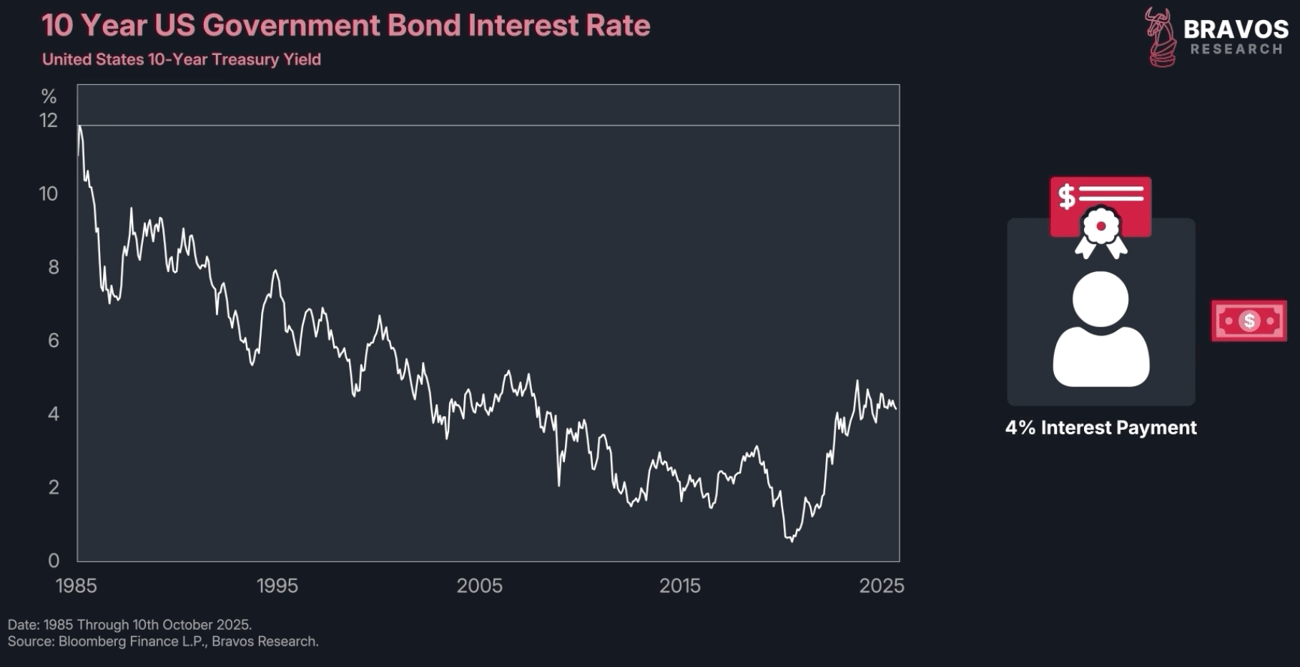

The 10-year government interest rate is the benchmark for government bonds, and it currently stands at around 4%.

This means anyone holding a 10-year government bond to maturity receives a 4% interest payment for 10 years.

This rate essentially determines how expensive it is for the government to borrow money. |

|

|

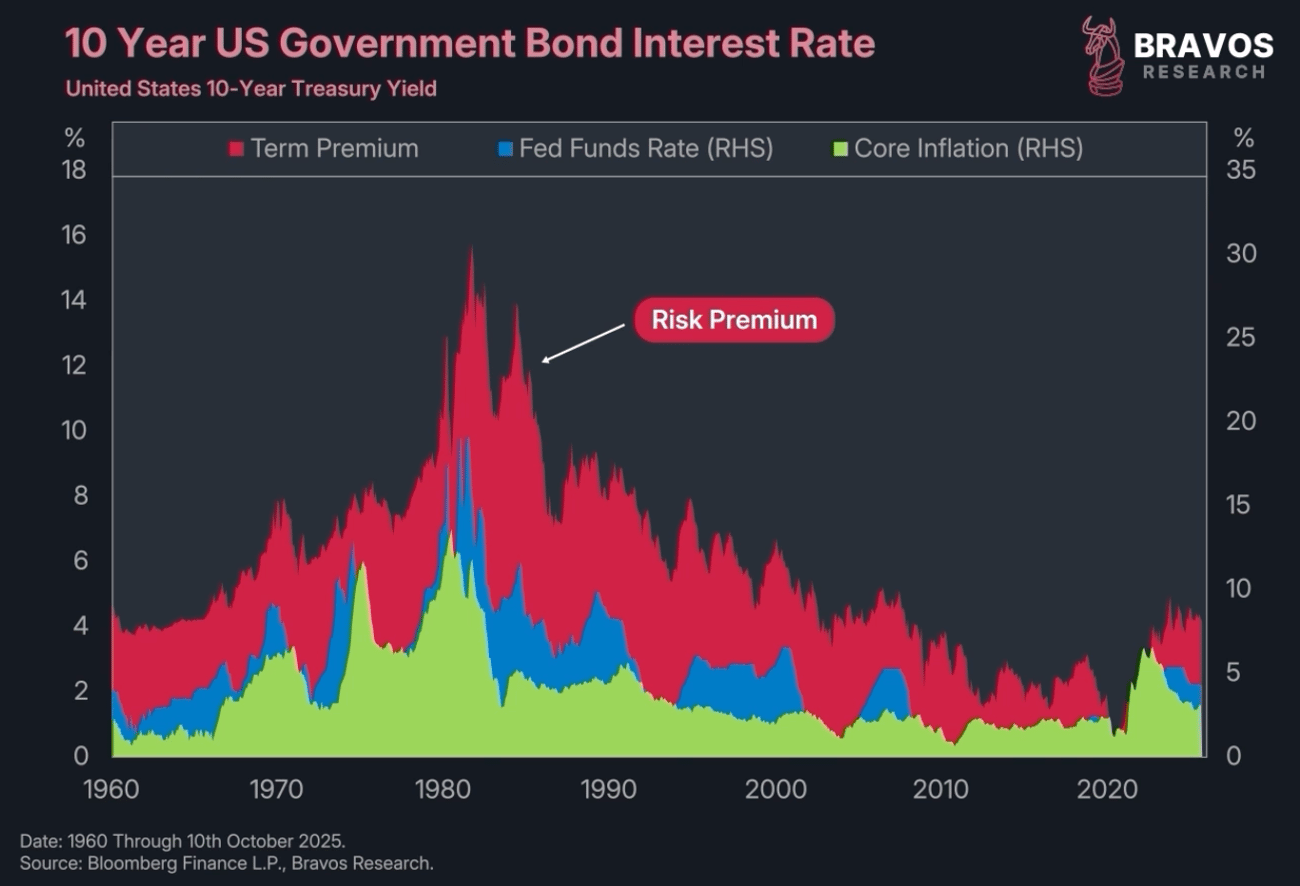

This interest rate is driven by 3 key forces:

Inflation - a key factor investors consider

The discount rate - the short-term interest rate set by the Federal Reserve

The term premium - essentially the confidence investors have in US debt, what we can call the risk premium.

You might not have heard of it, but this risk premium is what could cause real damage in a debt doom loop scenario.

|

|

|

Think of risk premium as the added interest on top of the other 2 factors.

If investors have high confidence in debt stability, you get a low term premium that allows the government to borrow at cheaper rates.

And this premium can also go negative.

For instance, in 2019, it was at -1.5% as confidence in US debt was unbelievably high, allowing the government to borrow money at a cheaper rate and making it easier to pay off prior debt. |

|

|

If investor confidence is low, however, you get a higher risk premium.

Historically, we've seen it go as high as 5% in the US.

This typically only happens during periods of high uncertainty, big geopolitical risks, or reckless government spending.

For example, the risk premium on Greek bonds in 2010 at the heart of the European debt crisis was above 15%. |

|

|

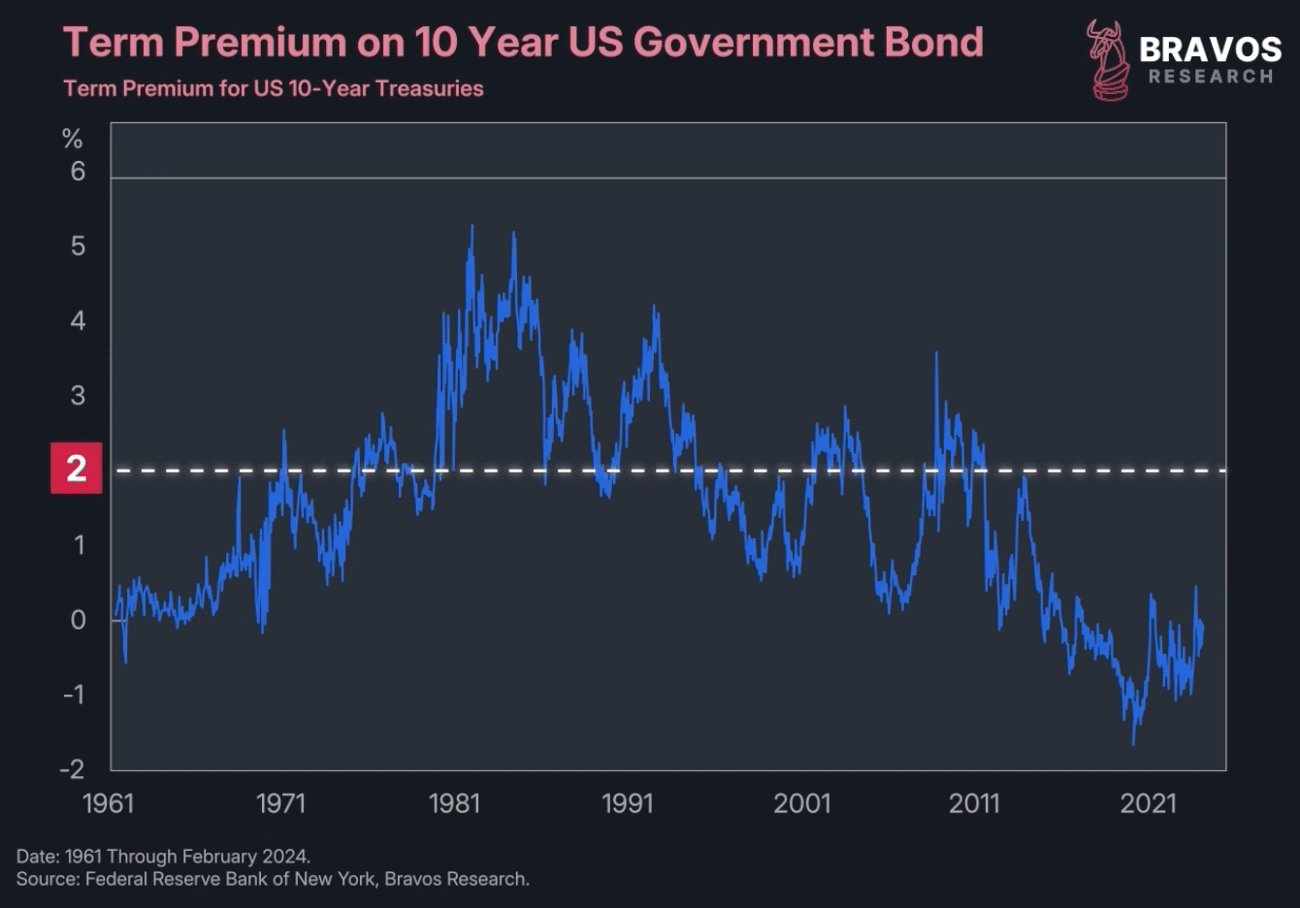

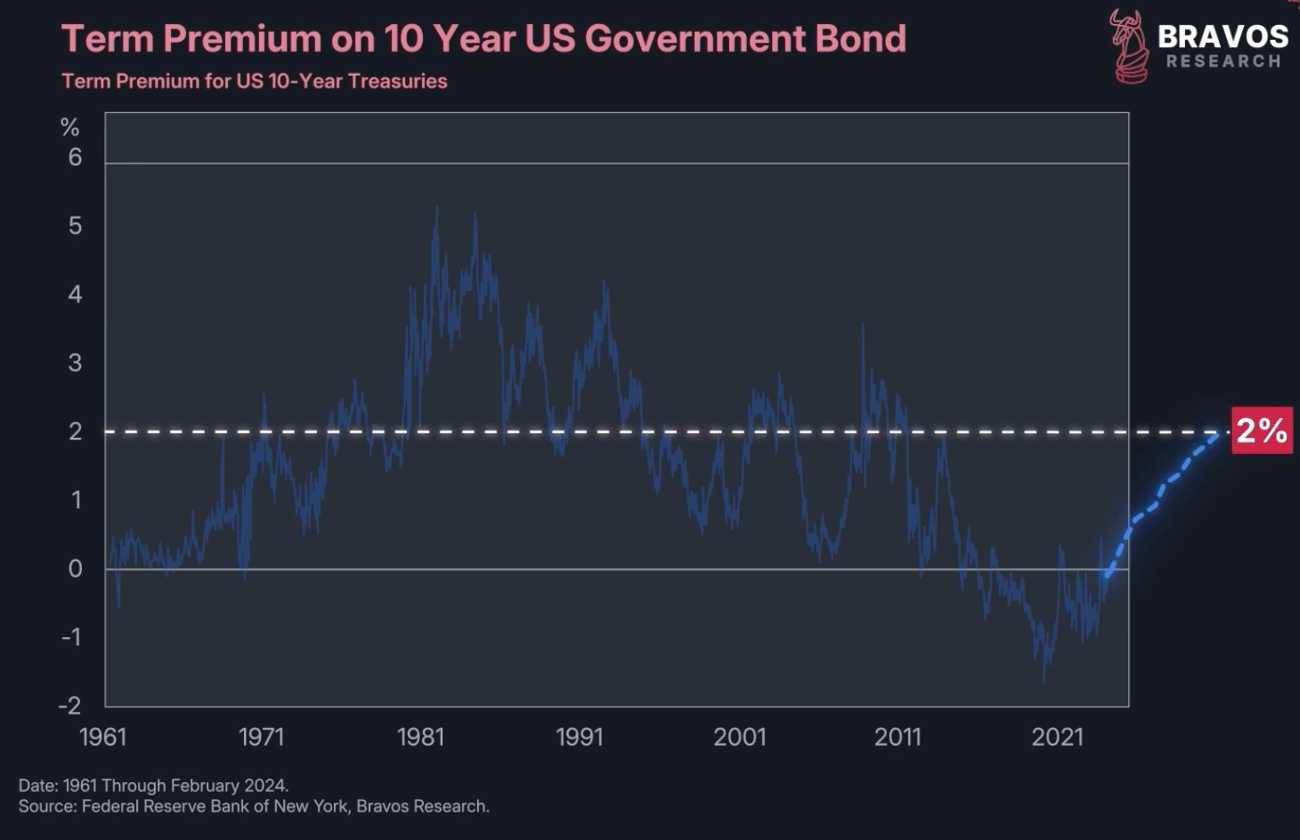

The historical average of the risk premium in the US is around 2%.

Today, the term premium on 10-year US government bonds sits at 0%.

This is potentially a major risk that could cause government interest rates to jump higher if investors suddenly decide US debt is becoming risky. |

|

|

If the risk premium were to just come back to its historical average of 2%, that would make today's 4% government interest rate jump to 6%.

This would have disastrous consequences on the government's budget.

It would also impact things like mortgage rates and borrowing costs for businesses, likely pushing the US economy into a recession.

This is obviously something the government wants to avoid.

So this is where the crypto reset fits in. |

|

|

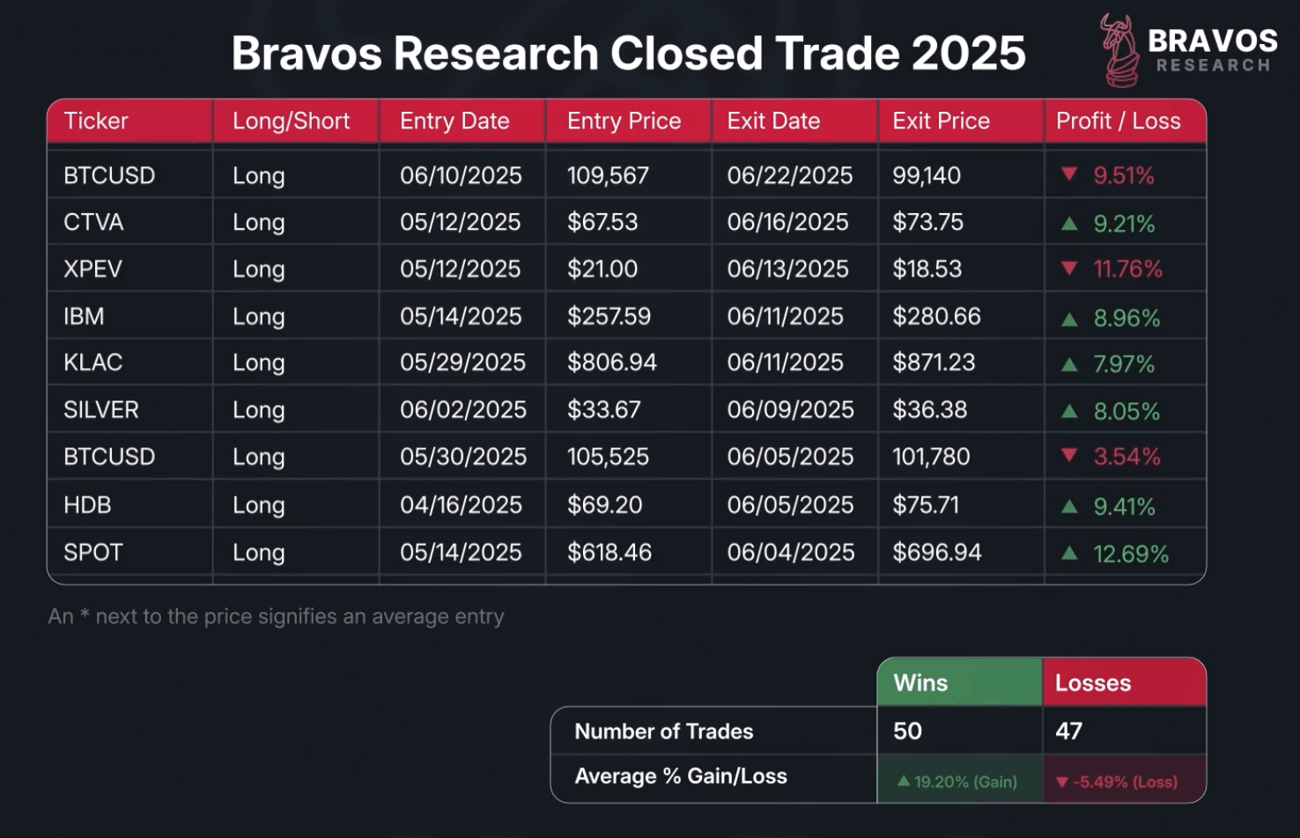

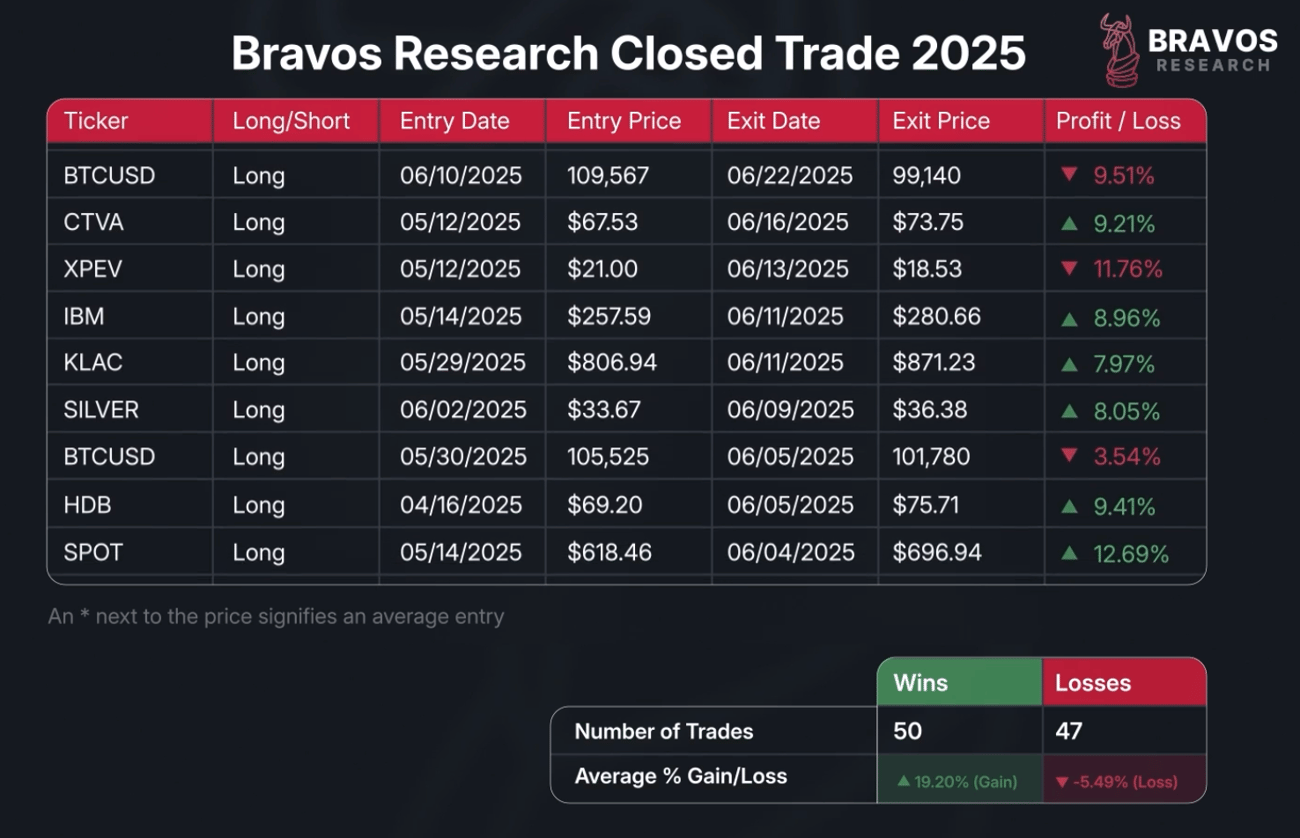

By the way, at Bravos Research, we trade not only cryptos, but also stocks, commodities, and bonds with typical holding periods ranging from a few days to several weeks.

We recently booked a 11.9% profit on Quanta Services and 25.81% profit on Nitto Denko.

Want access to our full range of Trade Ideas?

- Grab a subscription to join our community.

- Get our detailed analysis and actionable trade ideas.

- Check our track record for free on our website here.

Click here to get our complete Trading Strategy and real-time Trade Alerts

|

|

The Dollar's Declining Reserve Status |

|

Between 2000 and 2024, the US dollar represented at the very least 60% of global reserves.

This strong international confidence has been key to keeping a lid on that risk premium despite quite high levels of government spending. |

|

|

Just in 2023, we were still at 61% of international reserves denominated in US dollars.

But over the last year, things have been shifting quickly.

Today we're below 60% and dropping rapidly. |

|

|

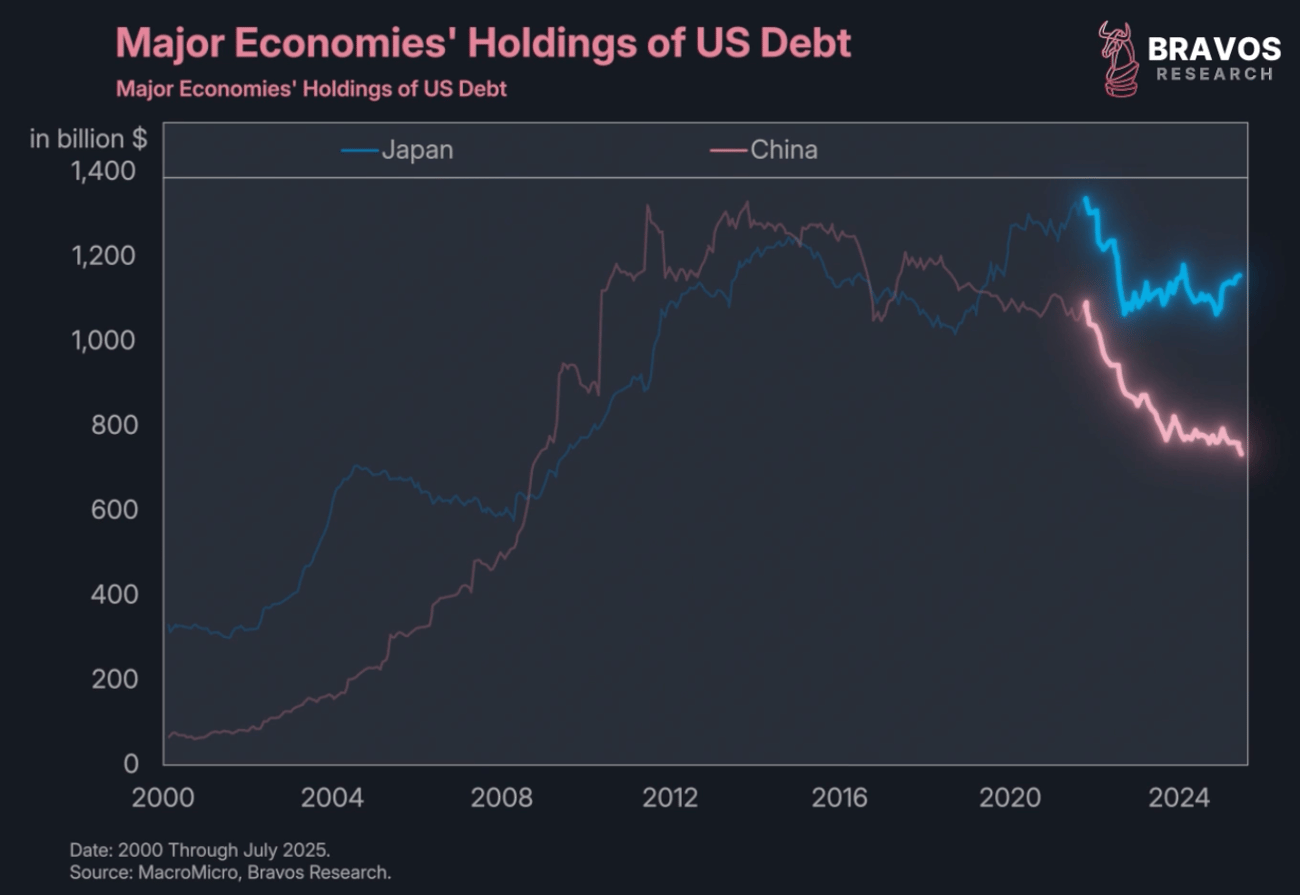

One big driving force behind this is that major foreign holders of US debt like China and Japan are selling.

Both China and Japan were huge buyers of US treasuries between 2000 and 2022 and have recently turned into net sellers just in the last couple years.

This is a phenomenon the US government has zero control over, but they're trying to potentially offset it through crypto. |

|

|

The Stablecoin Solution |

|

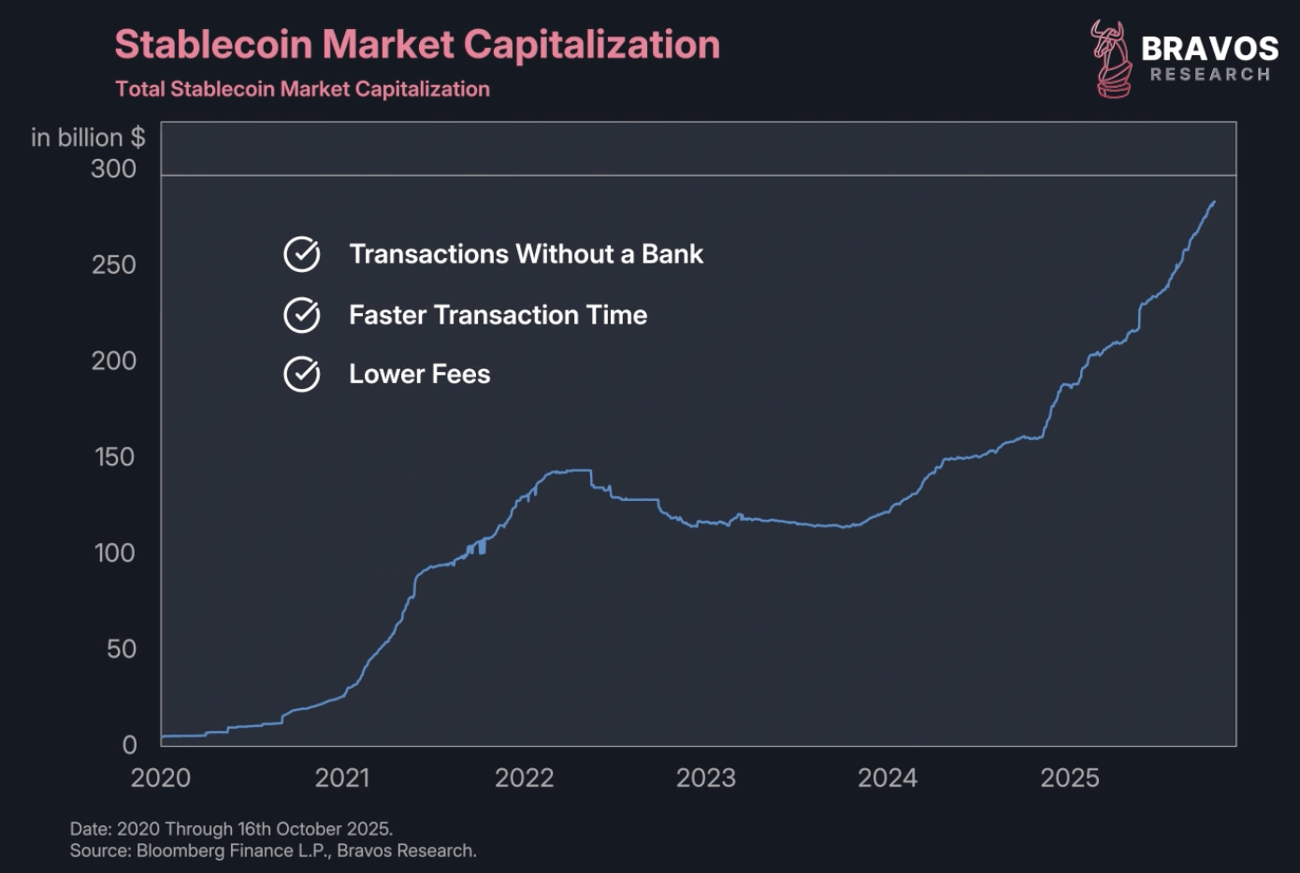

The market cap of stablecoins is now roughly $200 billion, having 2x from just 2 years ago.

These are digital dollars for anyone wanting easier US dollar transactions without passing through a bank.

These stablecoins also have faster transaction times and lower fees. |

|

|

The reason these are relevant is because for a stablecoin to be in circulation, it needs to be backed by a real US dollar.

In other words, companies that supply stablecoins like Tether and Circle need to purchase US treasuries to provide stablecoins.

Higher demand for stablecoins means higher demand for dollars.

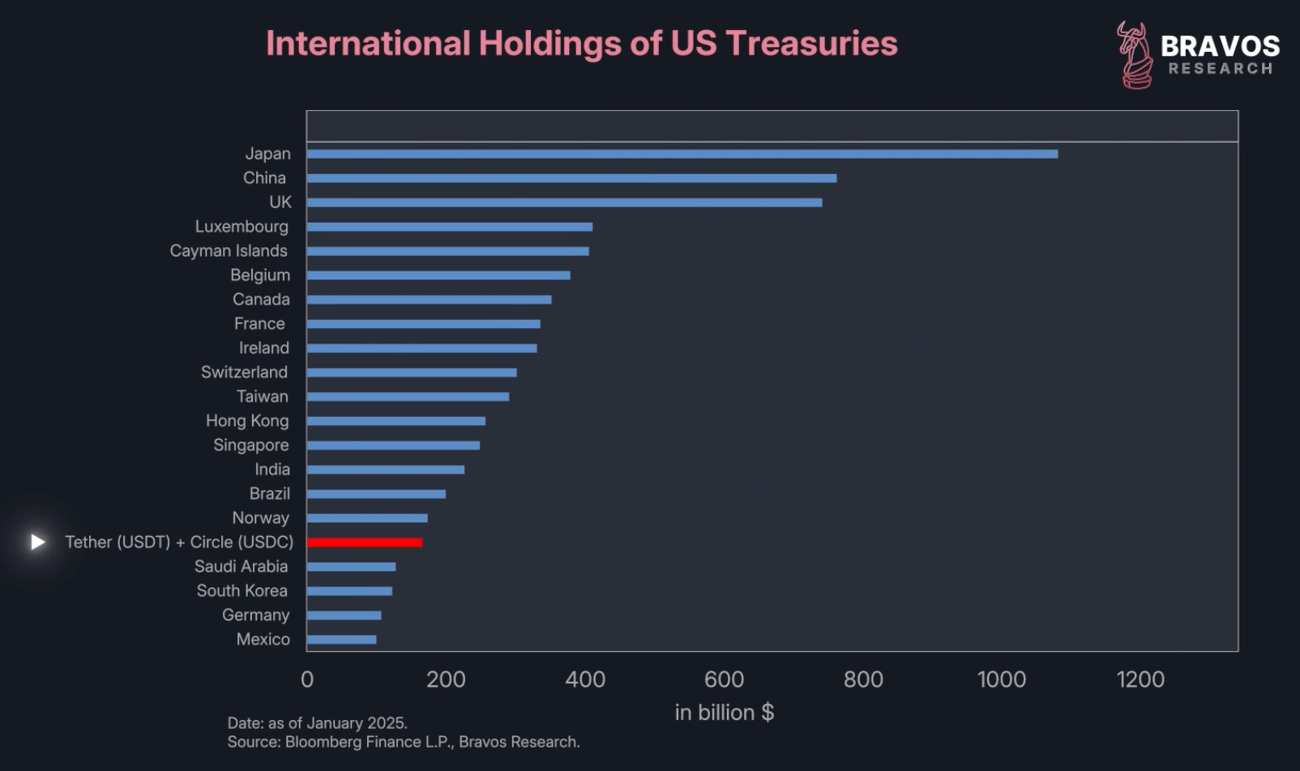

Tether and Circle are already among the world's largest holders of US Treasury assets with comparable holdings to Norway and Brazil's government.

And this is a market that is growing incredibly quickly.

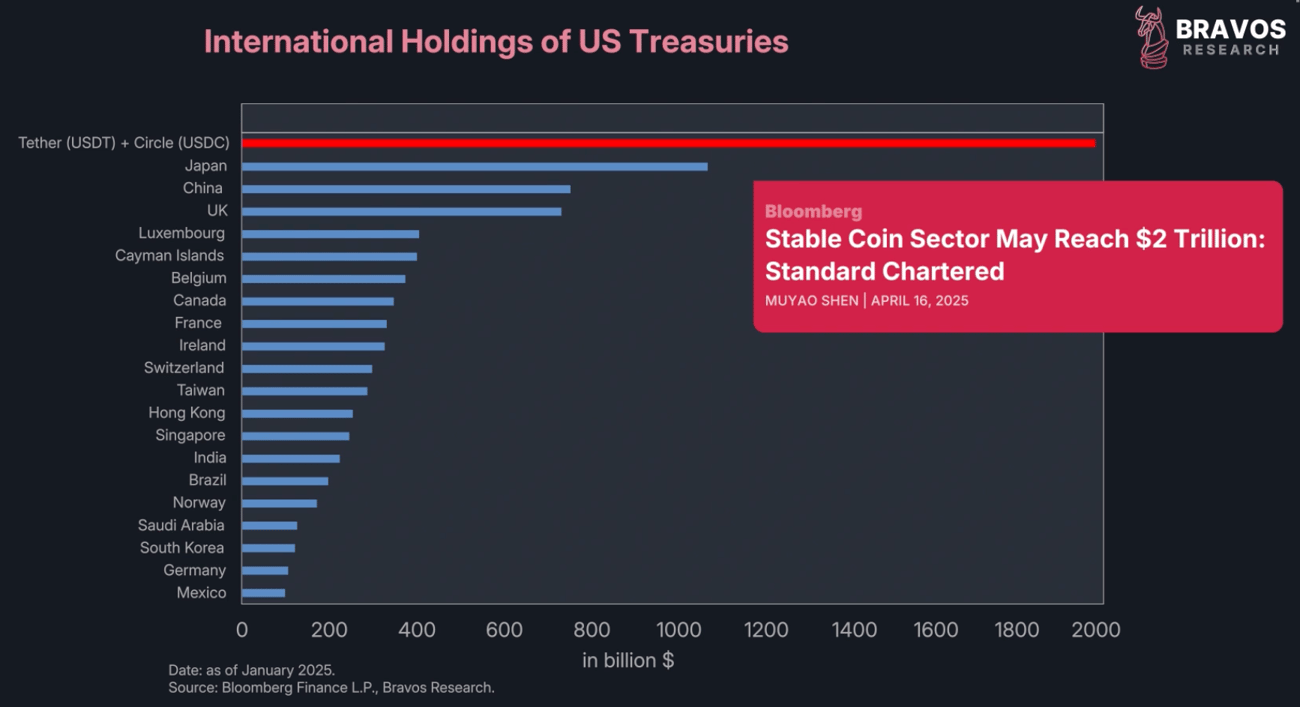

US Treasury Secretary Scott Bessent believes a $2 trillion market cap for stablecoins is a reasonable estimate.

That would make stablecoin companies the world's largest holder of US treasuries.

|

|

|

This would completely offset any reduction in US treasury holdings that other governments might do.

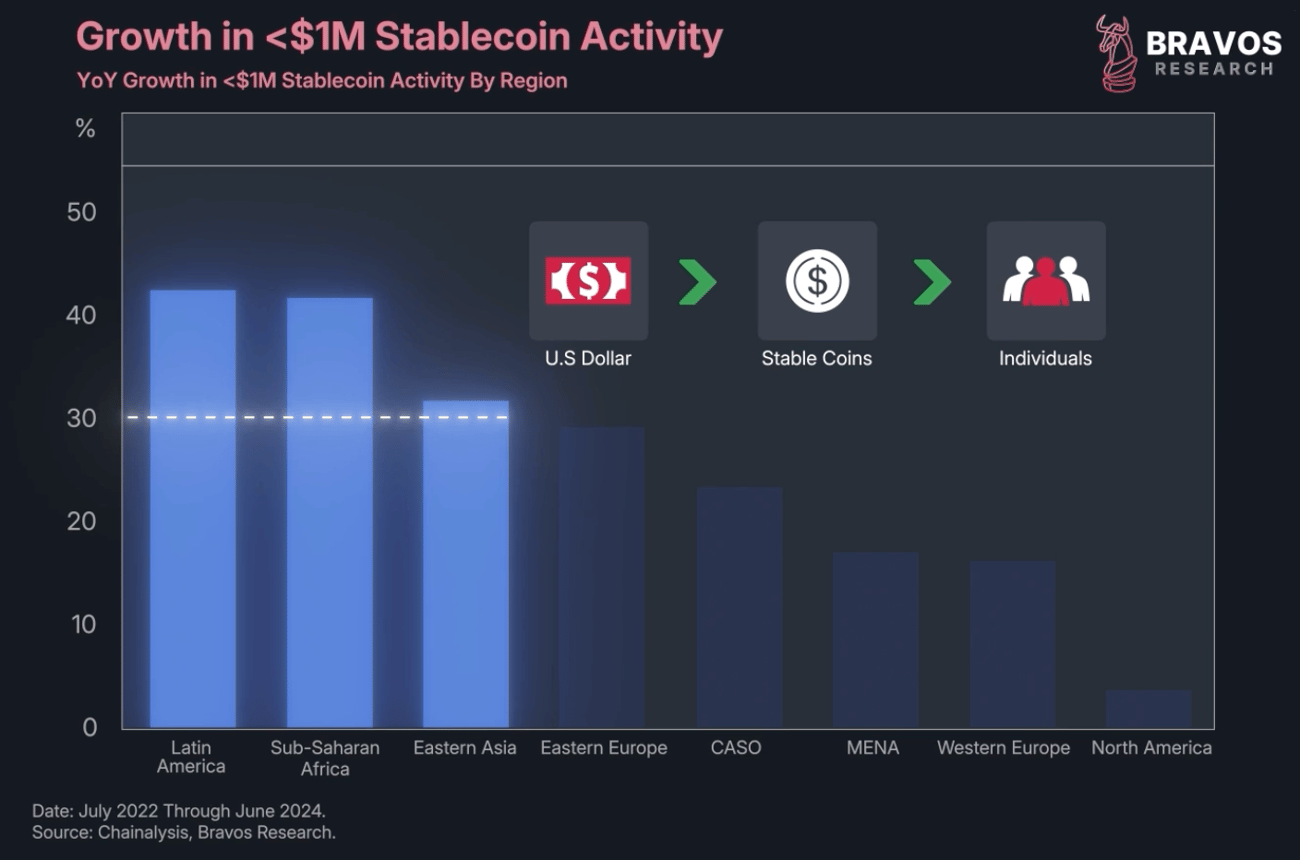

The $2 trillion estimate has also been validated by third parties like Standard Chartered, which believes 2/3rd of this growth will come from individuals in emerging markets. |

|

|

This is something we're already seeing today with Latin America, sub-Saharan Africa, and Eastern Asia witnessing 30% year-over-year growth rates in their stablecoin activity.

These are parts of the world notoriously susceptible to unstable monetary systems.

Stablecoins provide individuals with access to a stable currency - the US dollar.

|

|

|

The Critical Limitations |

|

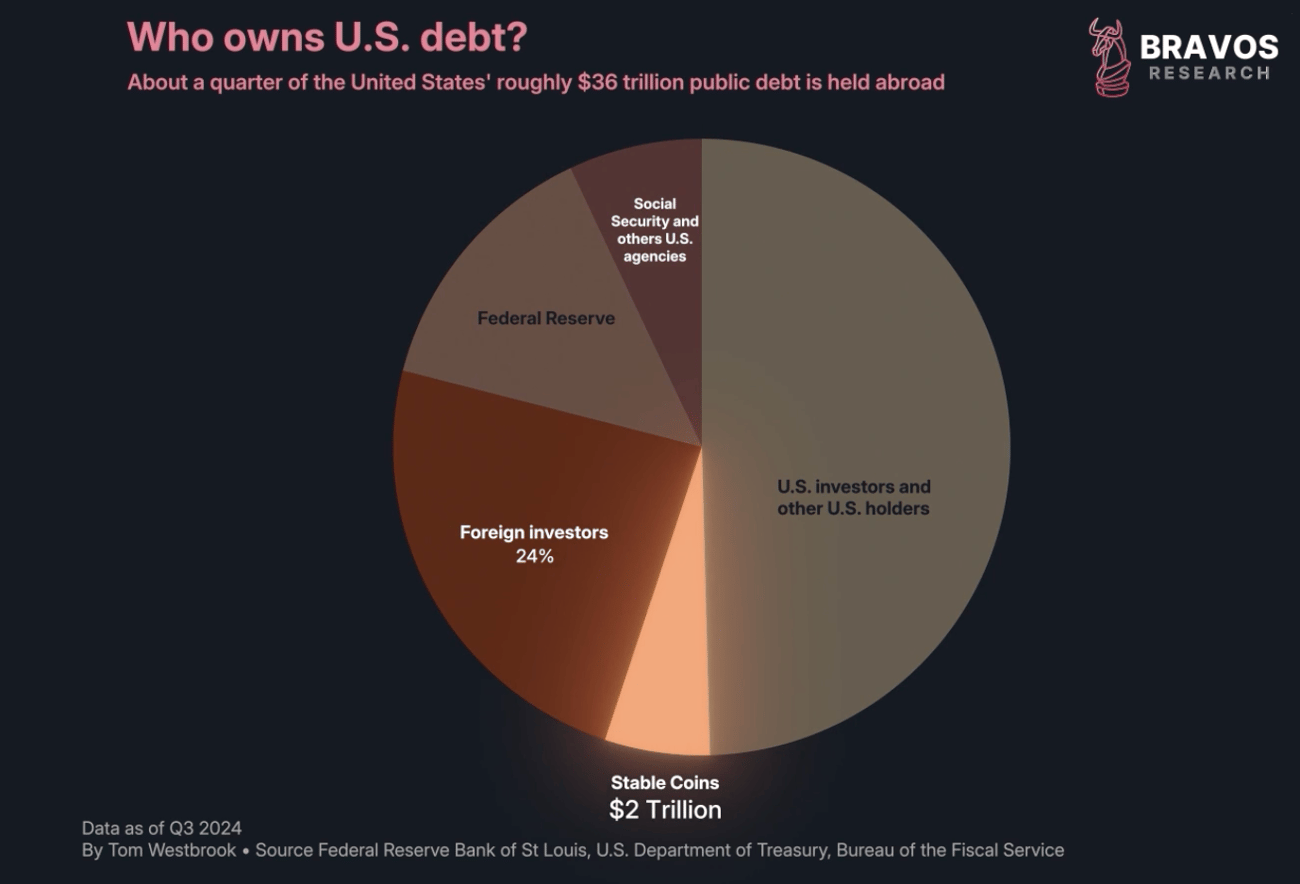

This entire plan does have huge limits though.

Foreign investors only account for about 24% of all holders of US debt.

Remember, national debt now stands at over $38 trillion and it's growing rapidly.

Even if stablecoins grew to a $2 trillion market, this would only represent a fraction of the total debt pile. |

|

|

Yes, the government's crypto plan is a good one, but it's only going to have a positive effect on interest rates if accompanied by a sound government budget.

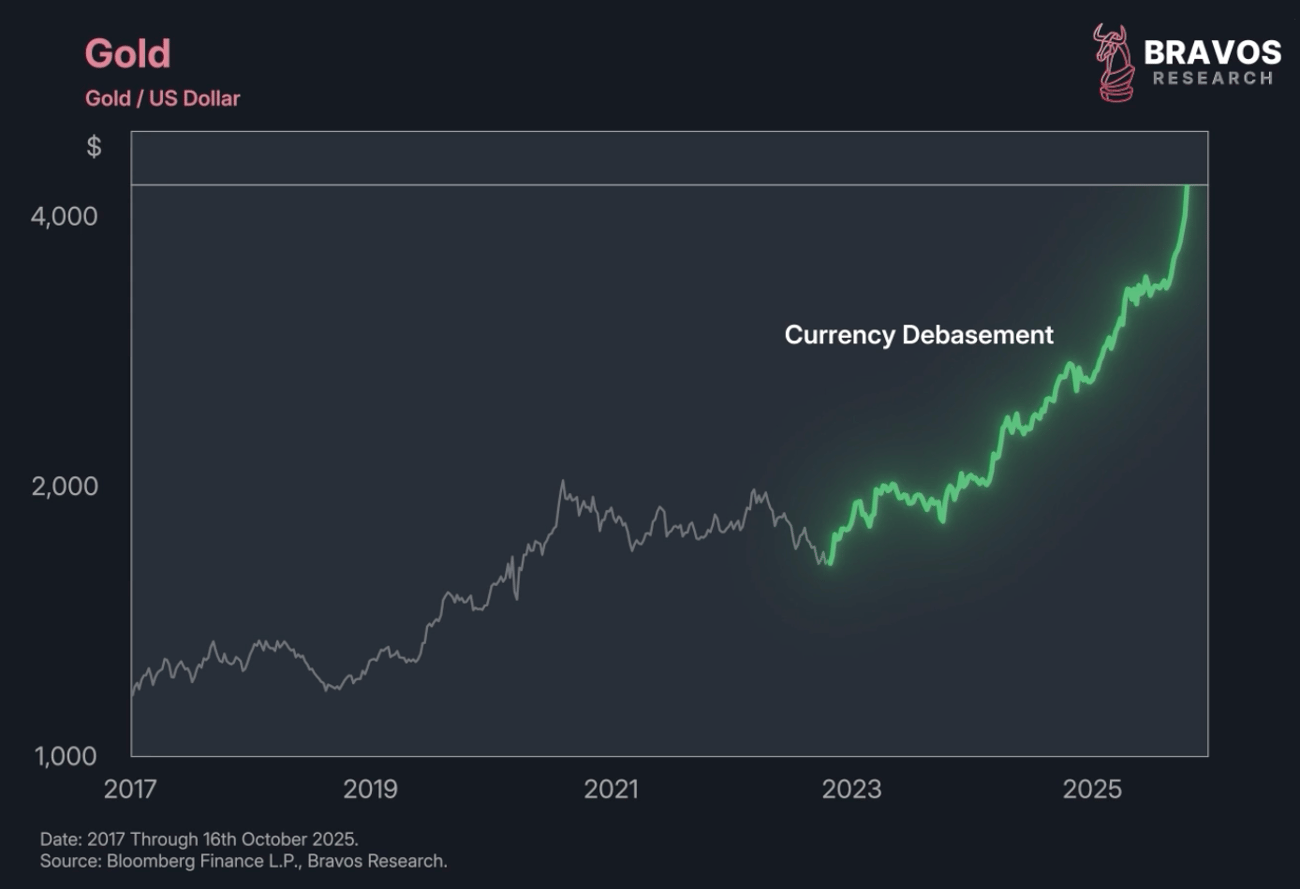

If the government continues spending recklessly, you'll see more capital flow away from US treasuries and into assets like Gold and Bitcoin that have been benefiting from loss of confidence in US debt.

Unfortunately, we don't think this theme is over. |

|

|

🚨 Ready to Profit From This Market Environment? |

|

Secure a membership to get access to:

- Our entire trading strategy

- Real-time buy and sell alerts for all our trades

- Supporting data and 3 weekly Premium Strategy Videos

- Guidance on booking profits and closing positions

Click here to get our complete Trading Strategy and real-time Trade Alerts |

|

|

|

|

Interested in more insights like these?

This article was originally published on Bravos Research. For more in-depth analysis and exclusive market insights, visit Bravos Research.

Contact us 24/7

Remember, we're here to help. If you have any questions, please contact us.

Warm regards,

The Bravos Research Team |

|

|