|

Inflation Retreats But Tariff Impact is Just Beginning

|

|

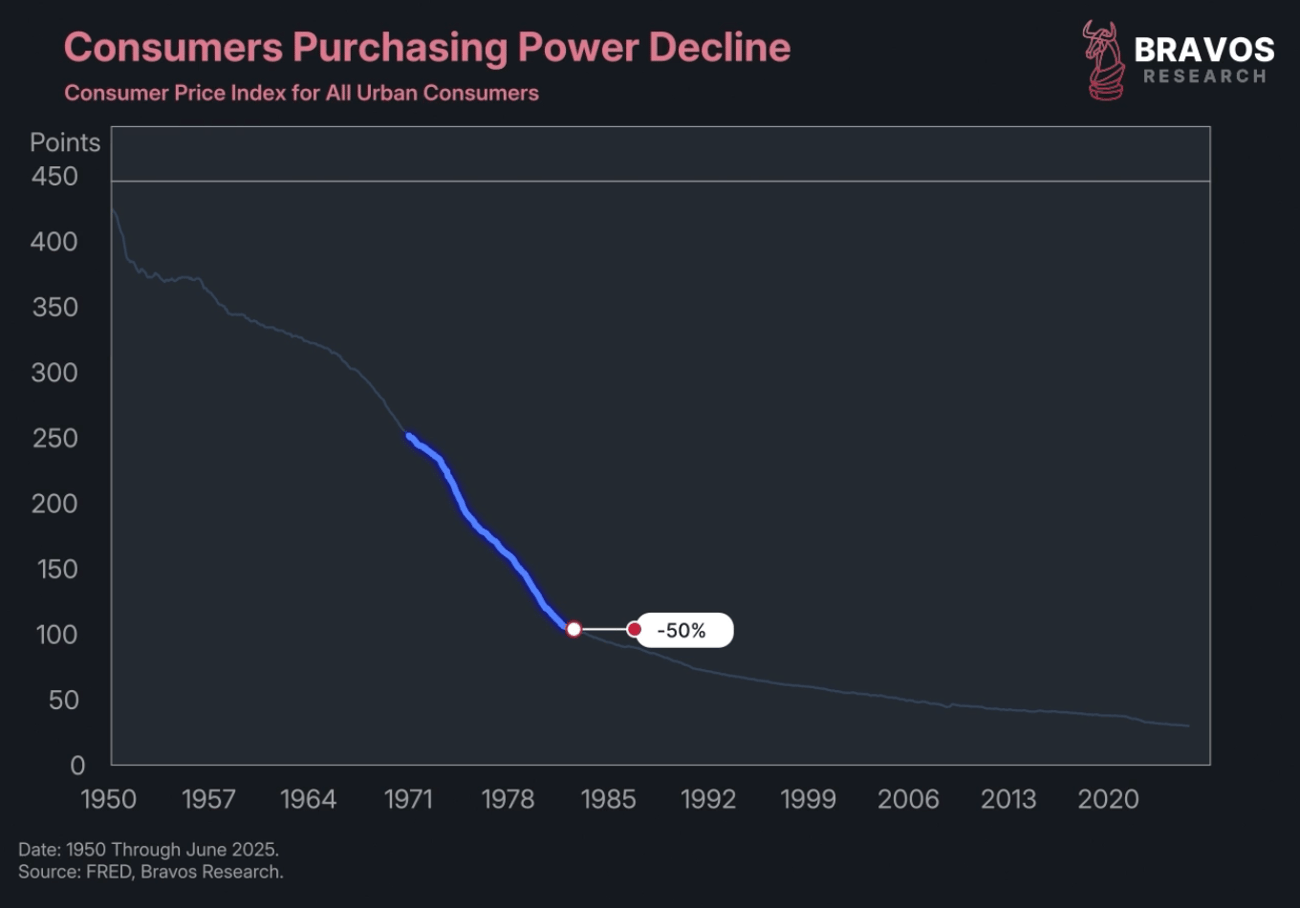

In 1970, the average price of a new car was $3,400.

A decade later, in 1980, that had doubled to $7,200.

Over the same time period, home prices went from $23,000, tripling to $64,000.

Milk doubled, beef doubled, and gasoline prices quadrupled.

Just over those 10 years, the US dollar lost approximately 50% of its value.

So, $1,000 saved at the bank in 1970 would have lost half its purchasing power a decade later. |

|

|

|

|

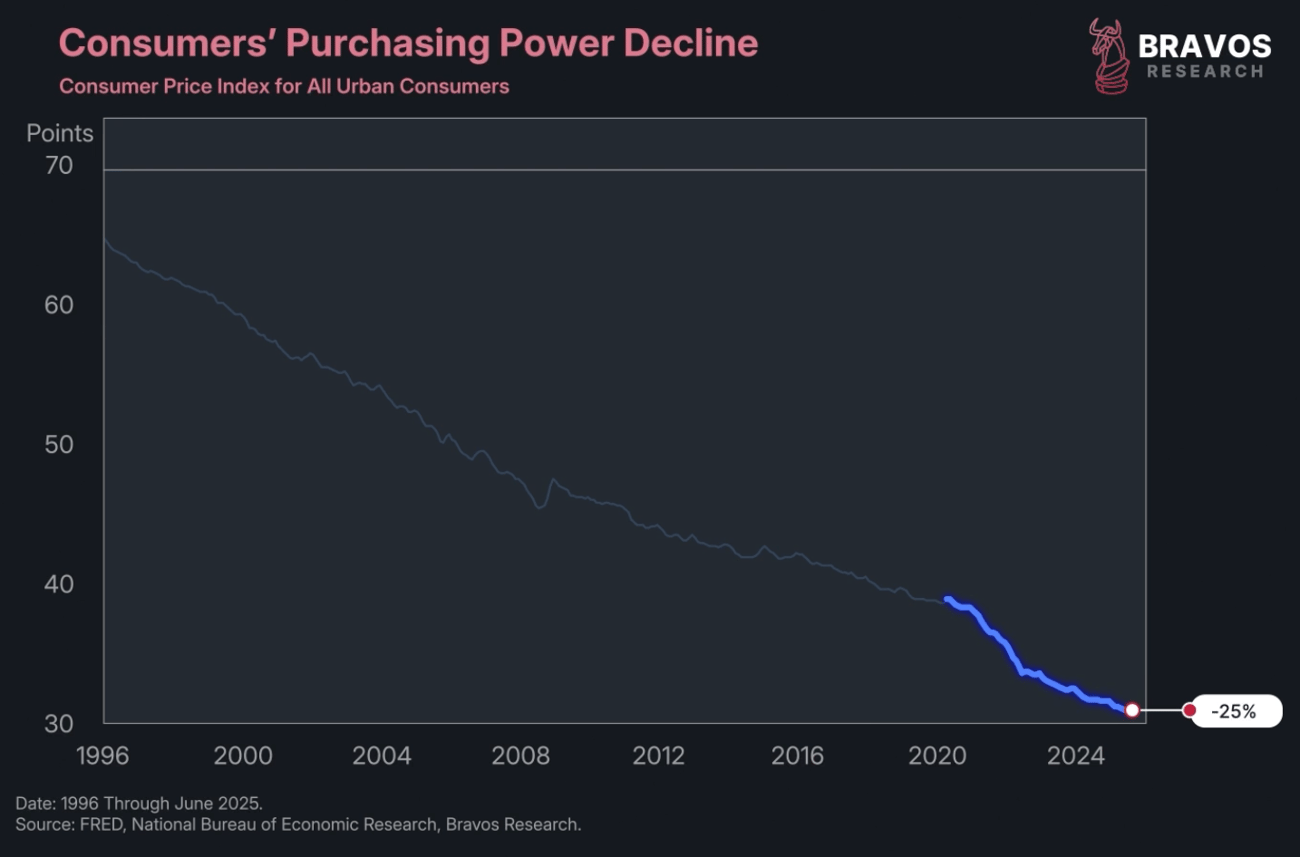

Today, since 2020, we've been experiencing something quite similar.

The US dollar has already lost 25% of its purchasing power since then.

And we have reason to believe this is about to accelerate downwards again. |

|

|

Since 2020, the average home price has gone from $350,000 to $500,000.

Gasoline prices have doubled from 50 cents to almost a dollar.

Beef and eggs have both tripled since 2020.

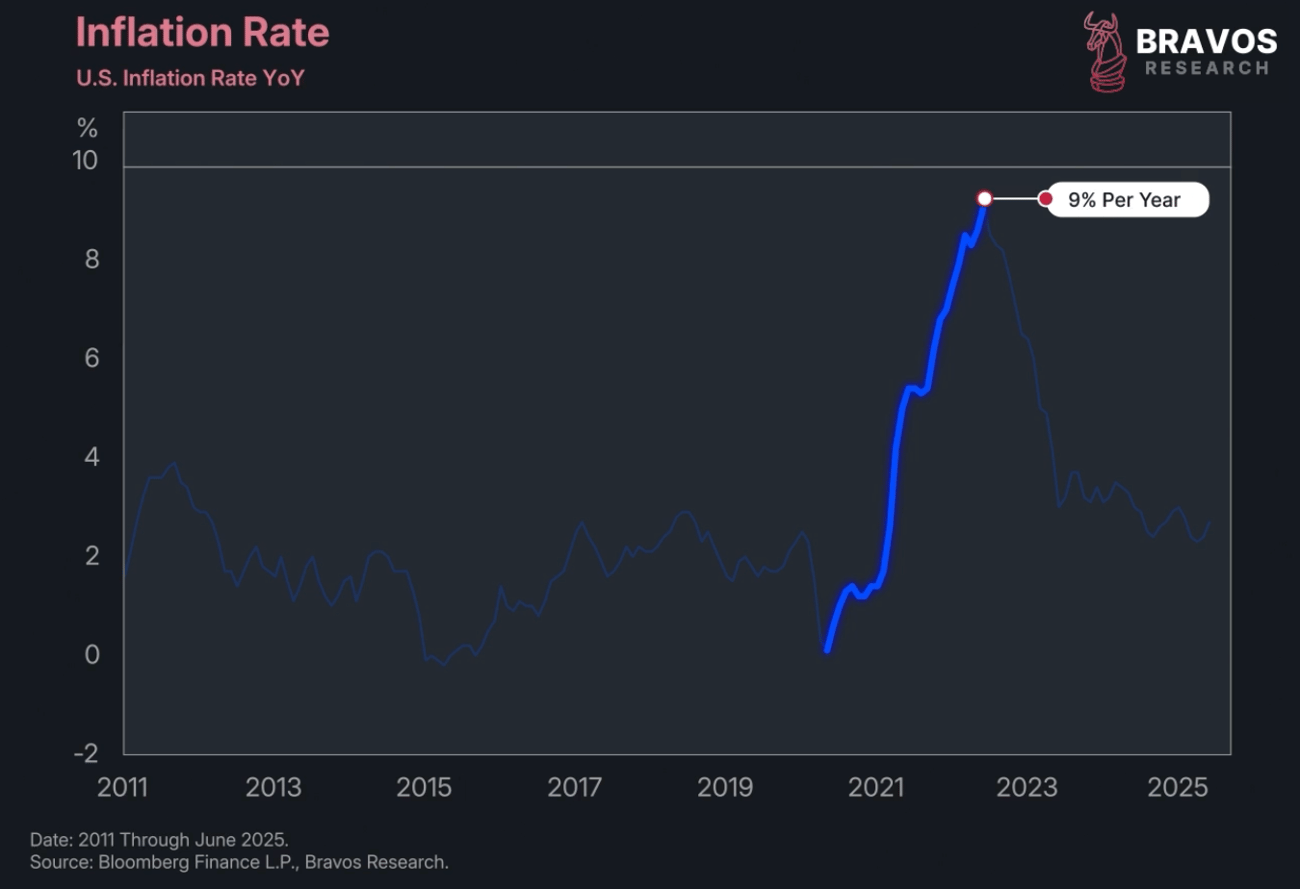

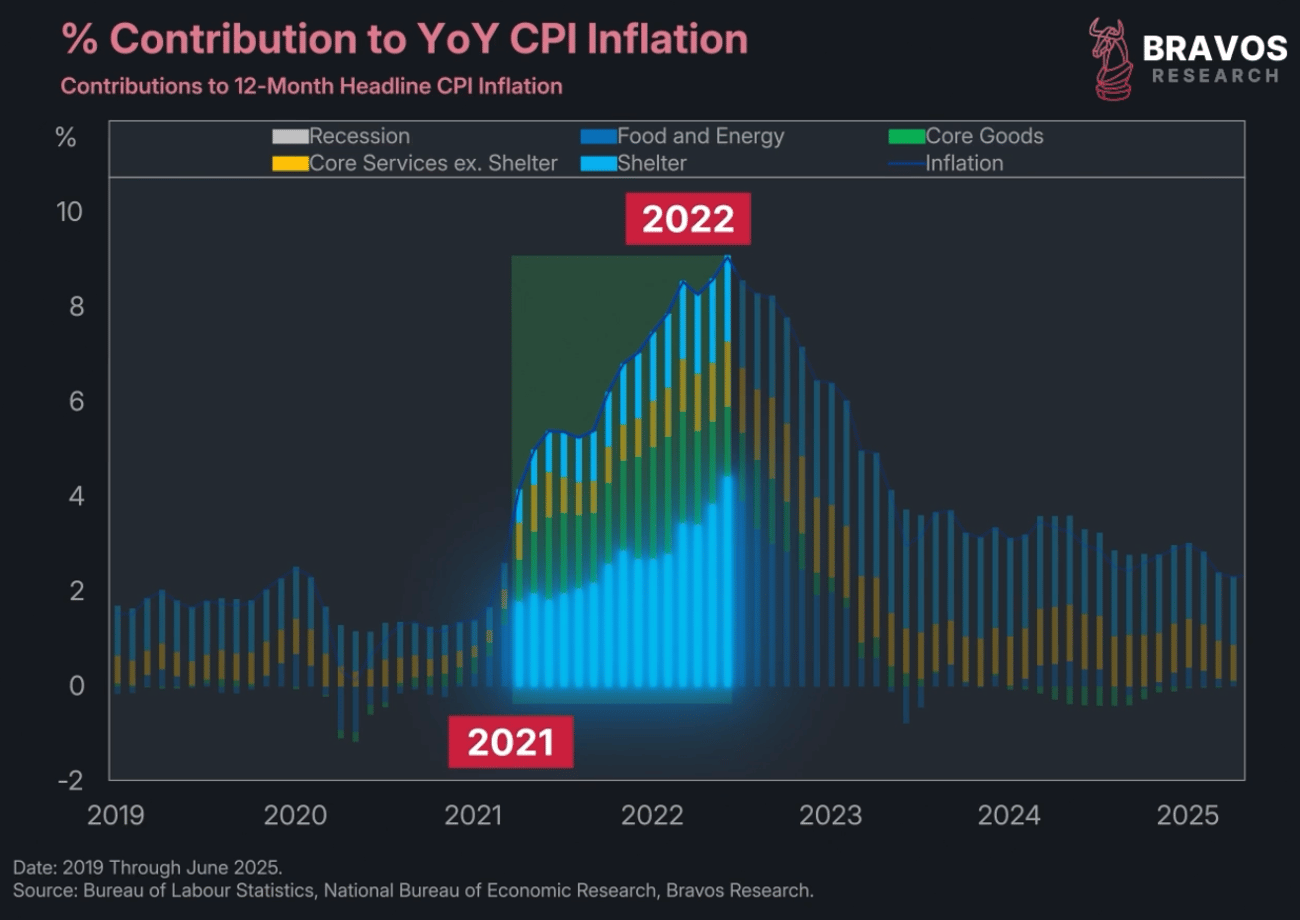

All of this led to the largest inflation spike in the United States since the 1980s.

The consumer price index (CPI) tracks how much everyday goods and services change in price each year.

In 2022, the inflation rate reached a record high of 9% per year. |

|

|

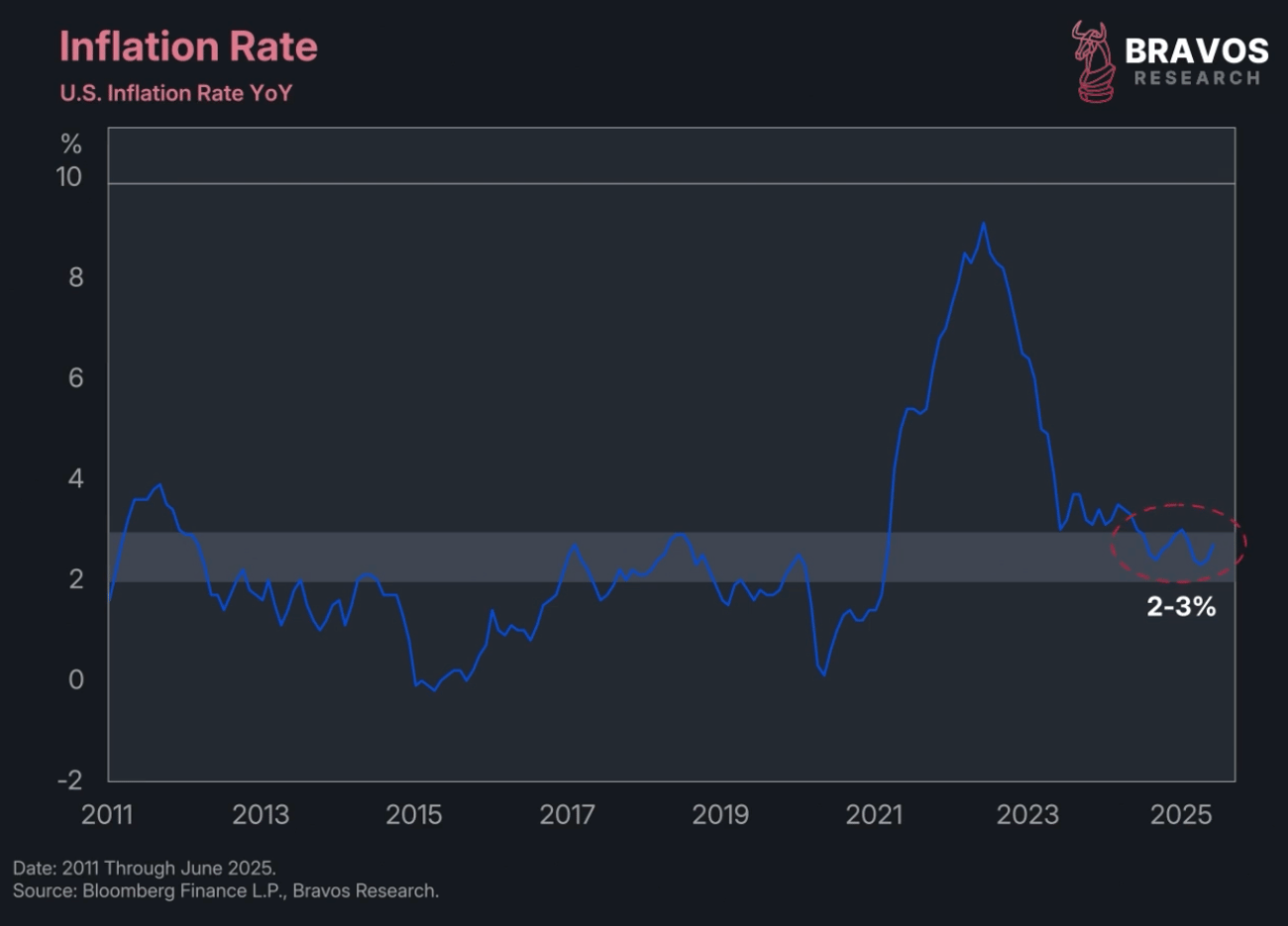

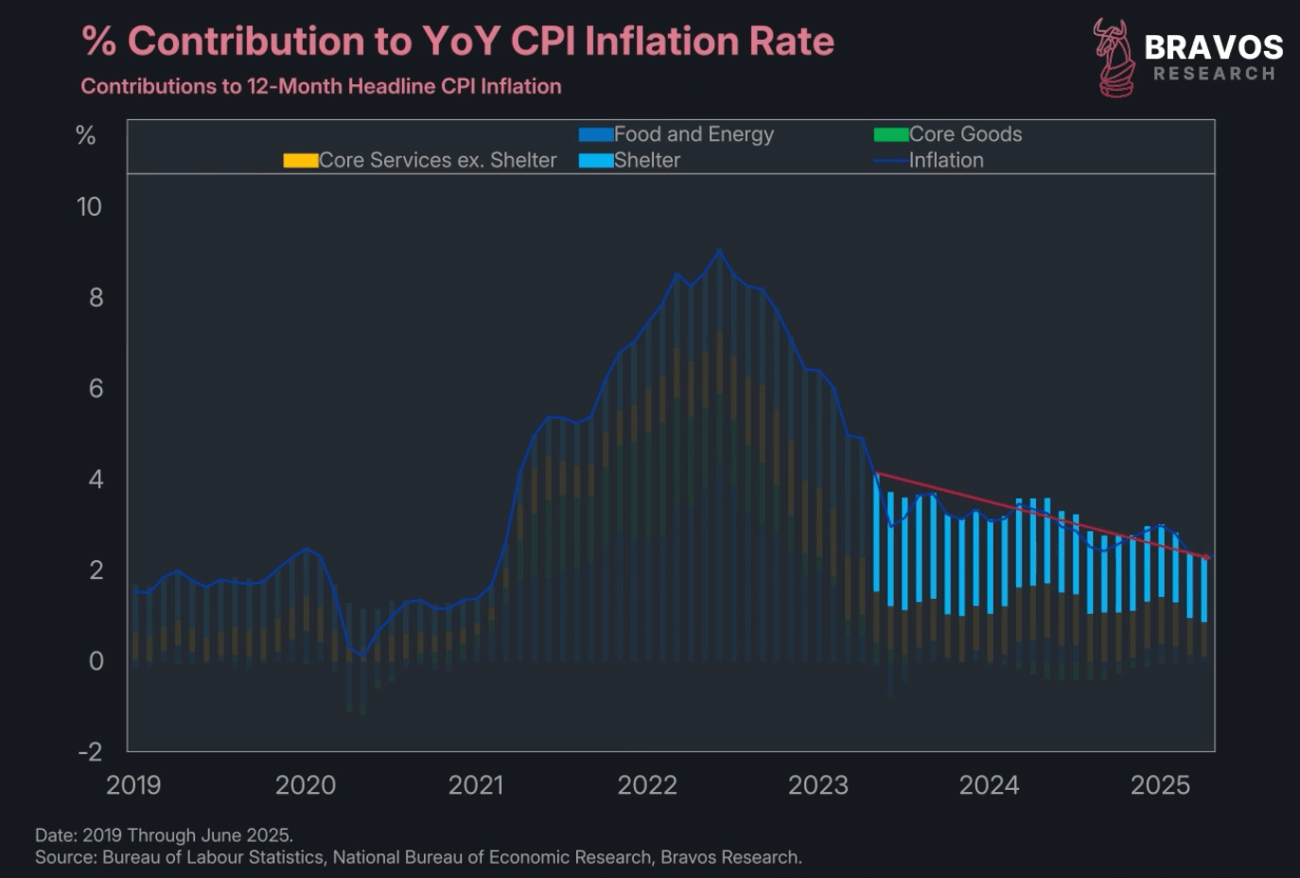

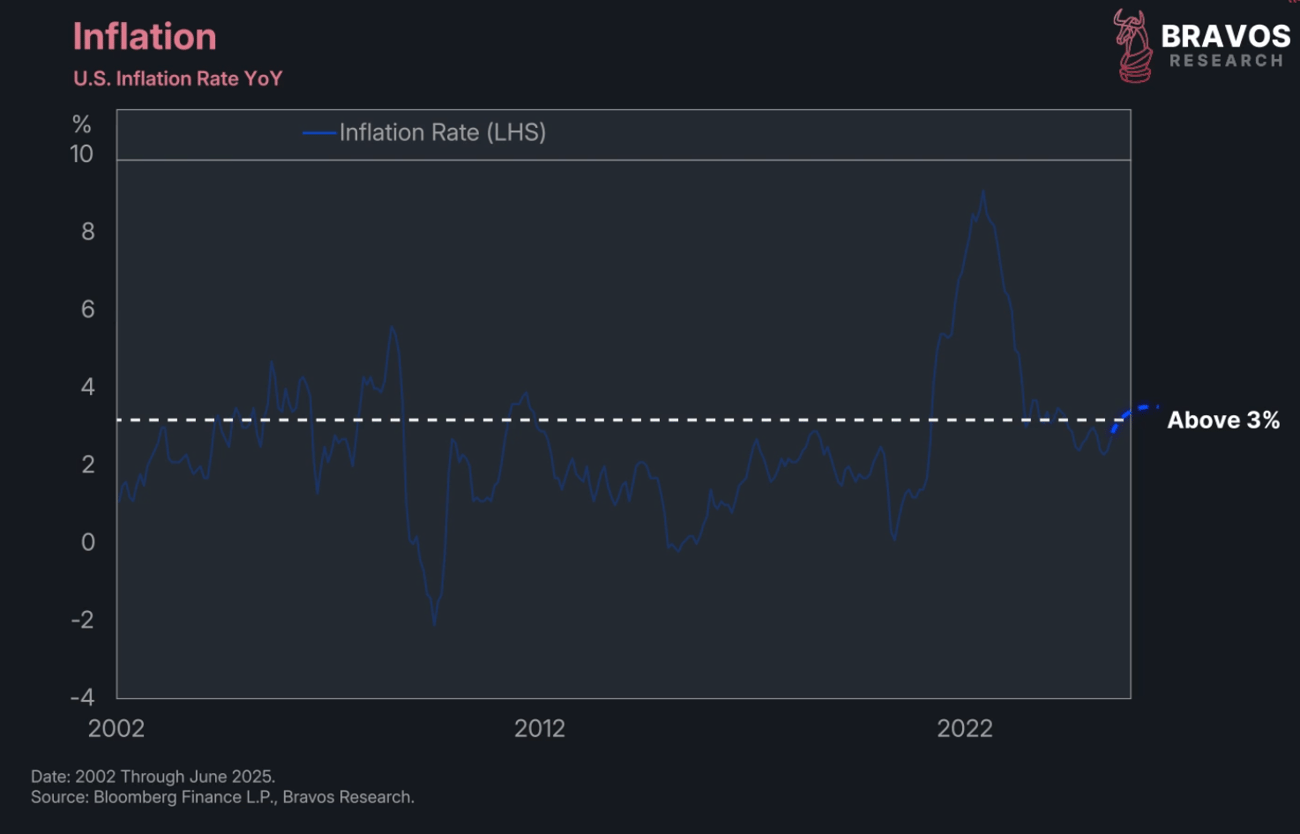

Since then, it has cooled down quite a bit.

Over the last 12 months, the US inflation rate has stayed between 2 and 3%, roughly in line with the Federal Reserve's target.

For the first time in years, we think there's a real risk that this begins to turn back up. |

|

|

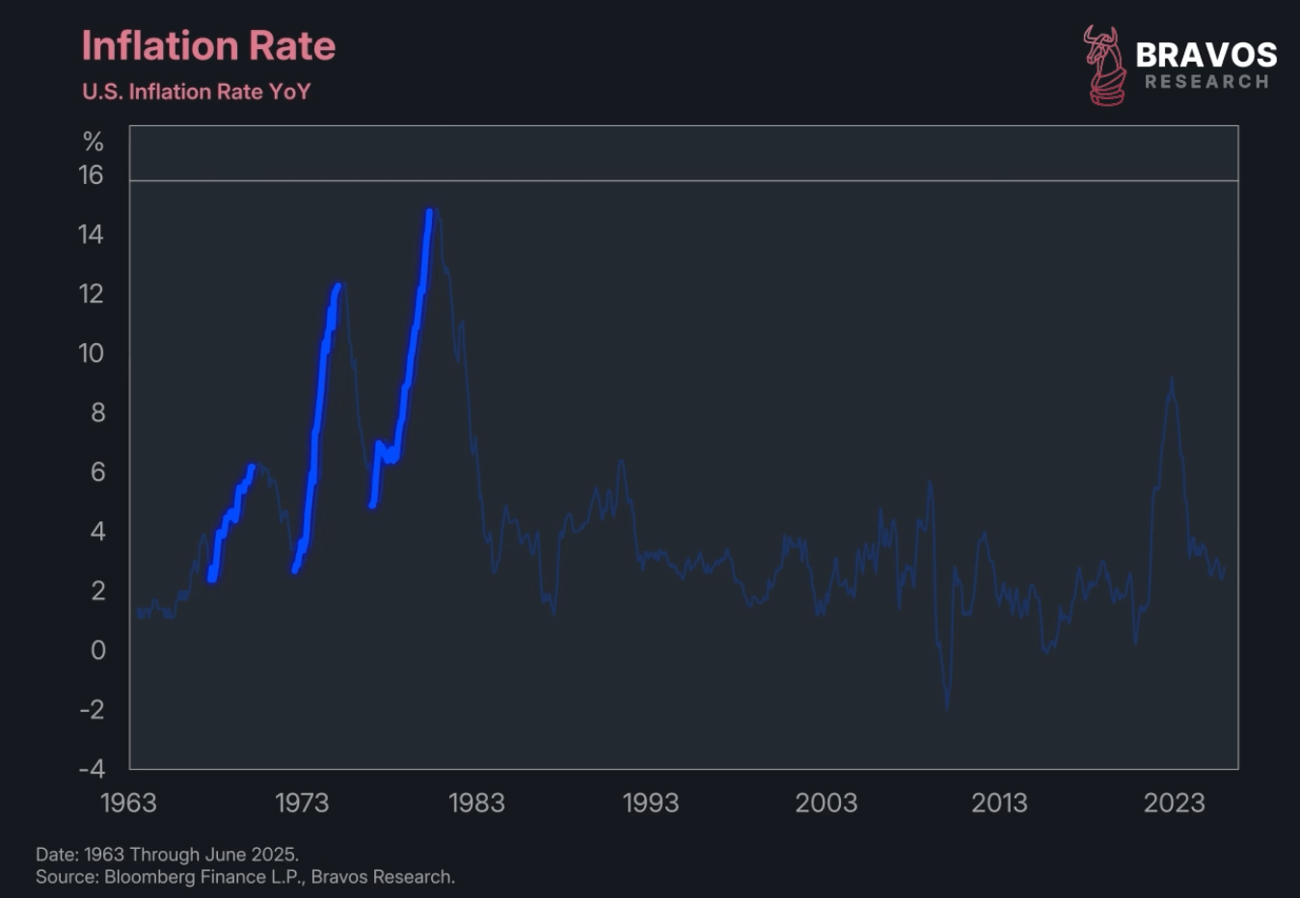

If we look at the 1970s inflation pattern, we see 3 distinct waves.

If the 1970s were to repeat, headline inflation could exceed 10%.

That would be disastrous.

So, let's zoom in and decompose the CPI to see exactly what is driving inflation today. |

|

|

The majority of inflation today is driven by shelter or housing and apartment rent prices.

This is an extremely slow-moving part of the consumer price index.

Since early 2023, it has been steadily moving lower. |

|

|

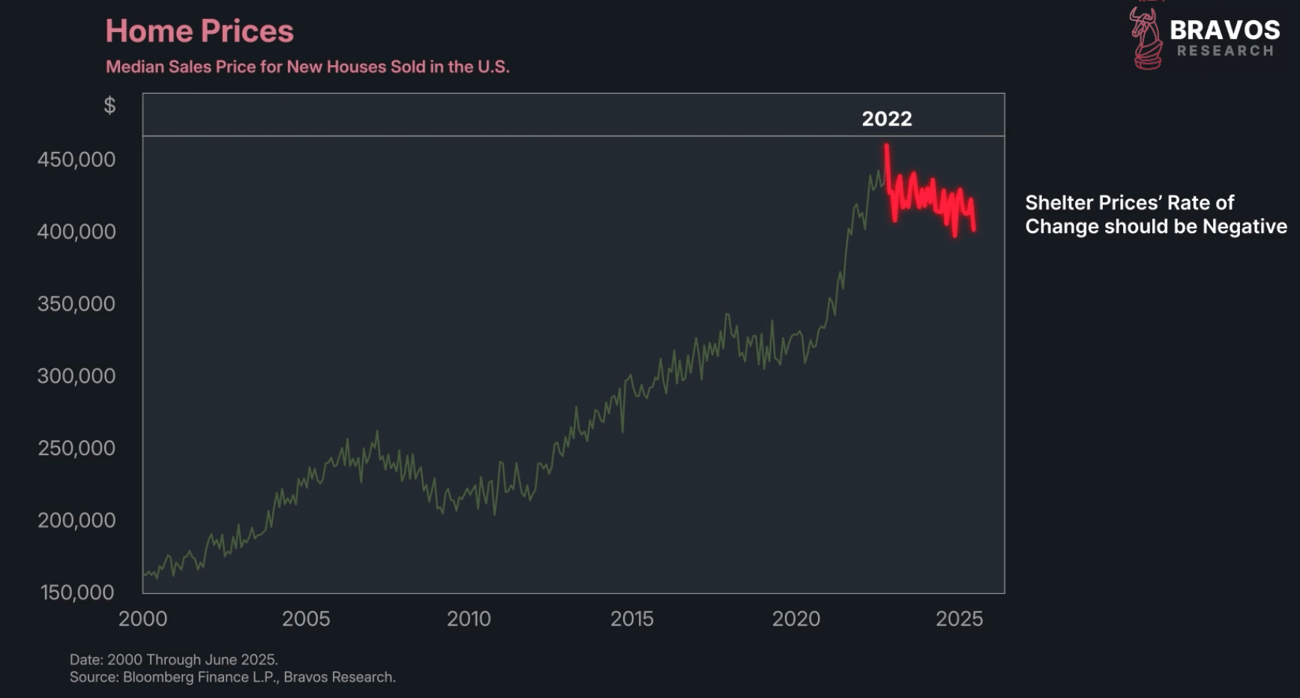

While home prices saw a huge increase between 2020 and 2022, they have cooled considerably since.

In fact, since 2022, you could argue that home prices have actually been declining.

So, if anything, the rate of change of shelter prices should be going negative, just like it did during the great financial crisis. |

|

|

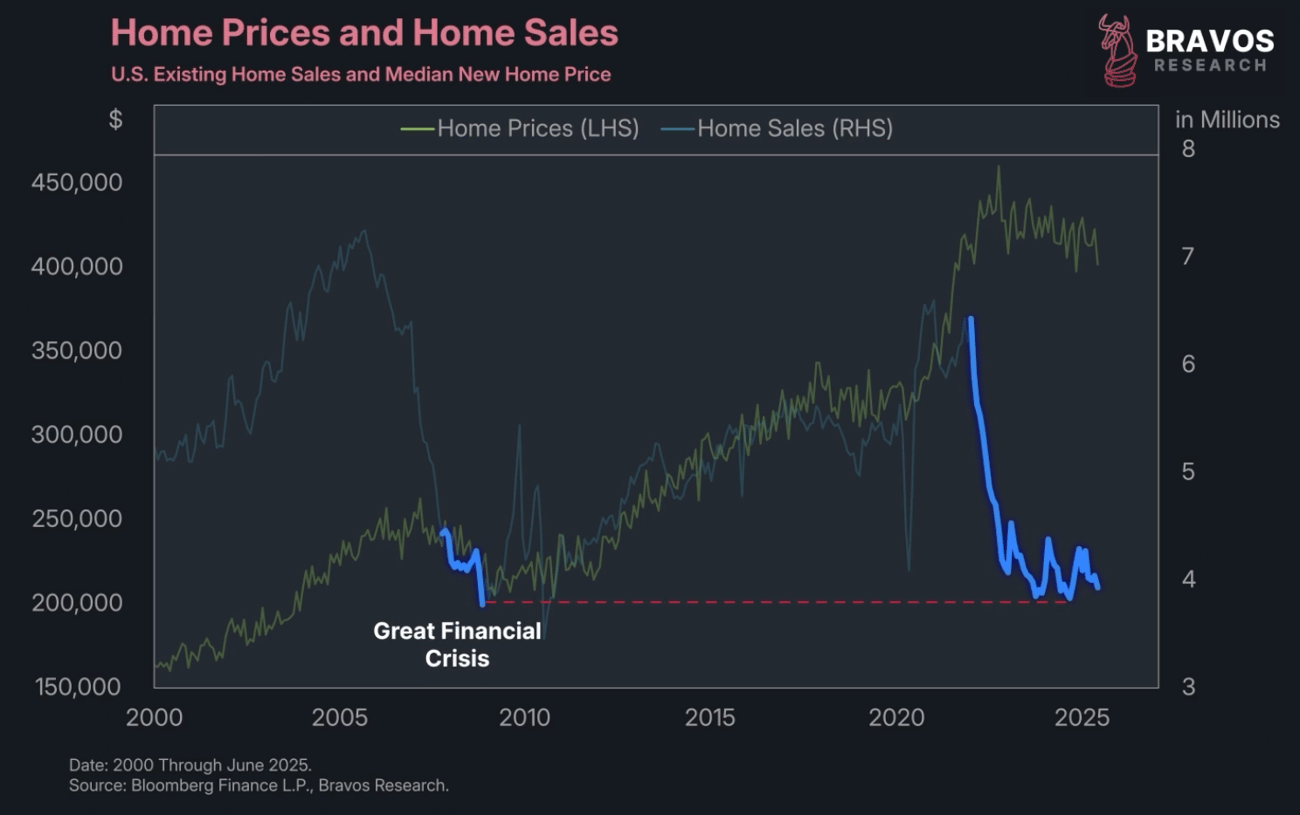

There's also no signs of seeing home prices turning back up just yet.

Home sales remain at very depressed levels due to high mortgage rates and the housing unaffordability crisis.

Housing activity is currently at roughly the same level as the heart of the great financial crisis in 2007.

So, the largest section of inflation today is unlikely to be turning back up anytime soon, which could provide further downward pressure on inflation.

But we think there's something that could push inflation higher by the end of this year. |

|

|

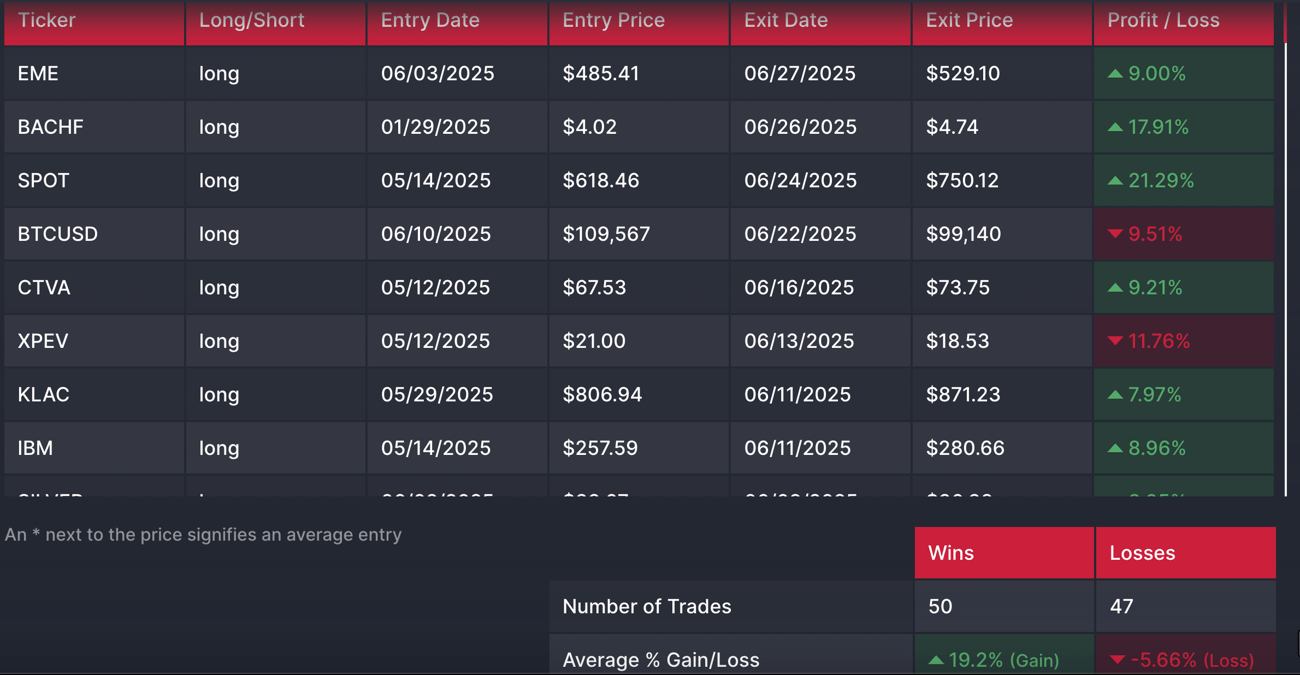

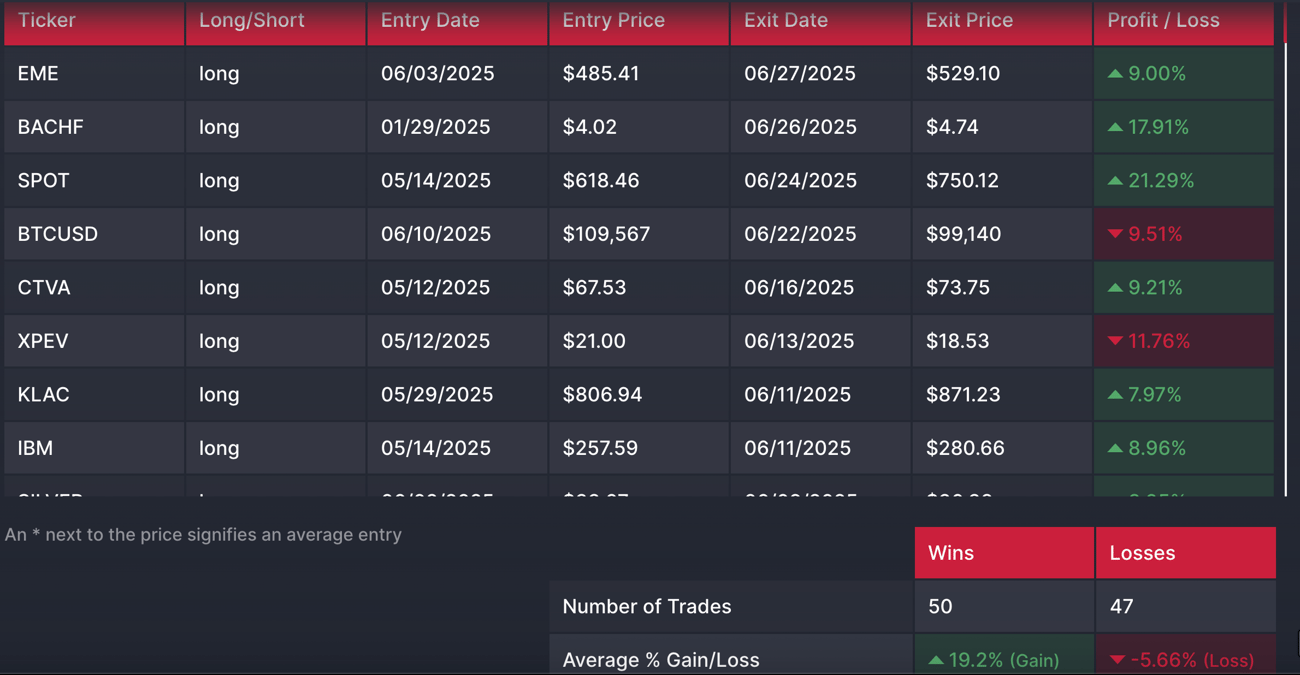

We've successfully navigated these markets in 2025, with an average gain of 19.2% and an average loss of only 5.66%.

We recently booked a 13.45% on $IBM.

View our entire track record for free on our website here.

Click here to get our complete Trading Strategy and real-time Trade Alerts

|

|

|

Now, although shelter is the largest CPI component, it's not what typically drives inflation higher.

Back in 2021 and 2022, the large inflation spike was driven primarily by food and energy prices.

While these don't carry the largest weighting, they can have sharp swings that drive big moves in headline inflation. |

|

|

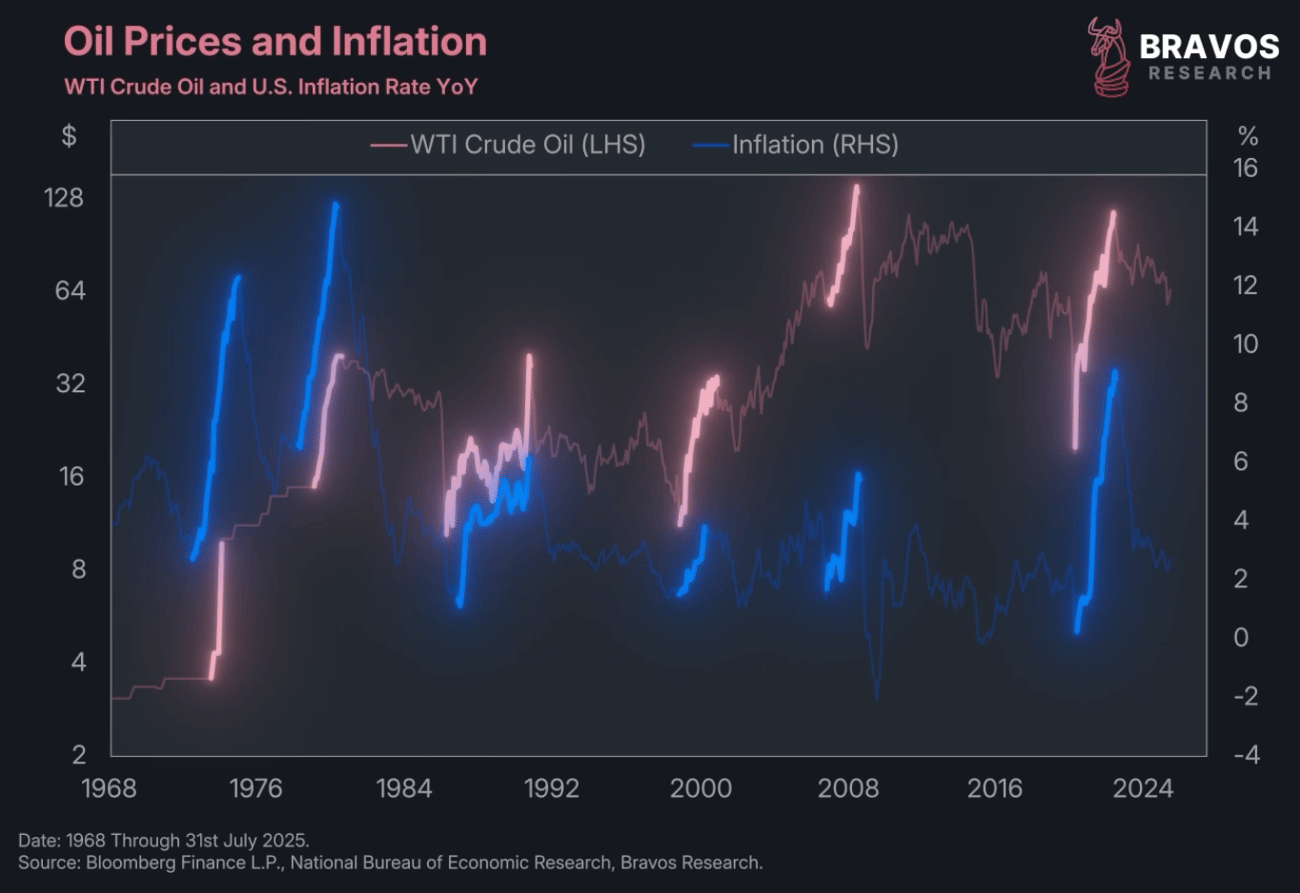

Rising oil prices translate into higher gasoline and diesel costs, making it more expensive to ship goods and travel.

These costs ripple through the economy, raising prices for everything from food production to factory operations.

In fact, most big inflation spikes have been a direct result of higher energy prices. |

|

|

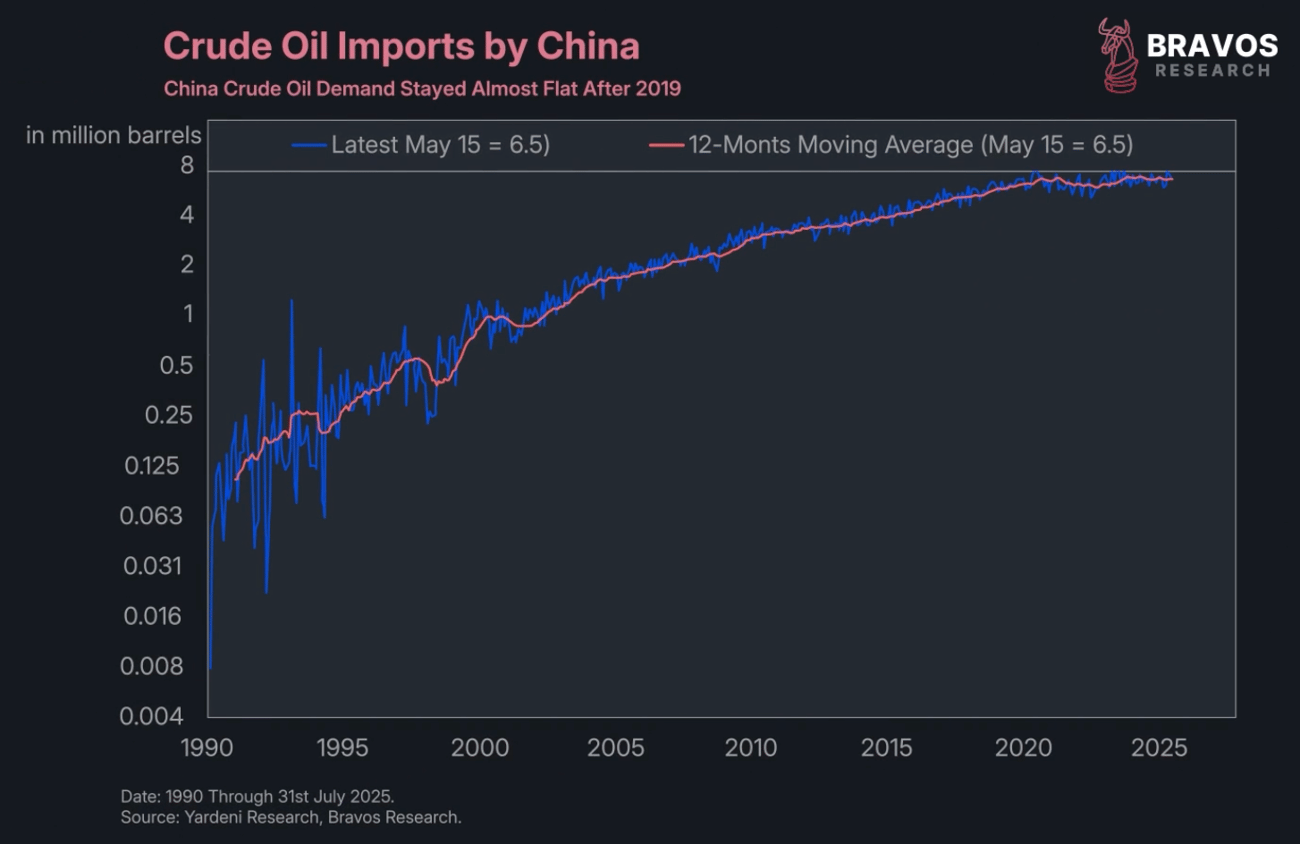

One plausible theory is that rapidly growing emerging markets like India and China could lead to a pickup in energy prices creating inflation in the US as a result.

But China's oil imports have largely remained flat since 2019.

They're going through housing and demographics crises, with no clear signs of rising demand from China that could drive oil prices higher. |

|

|

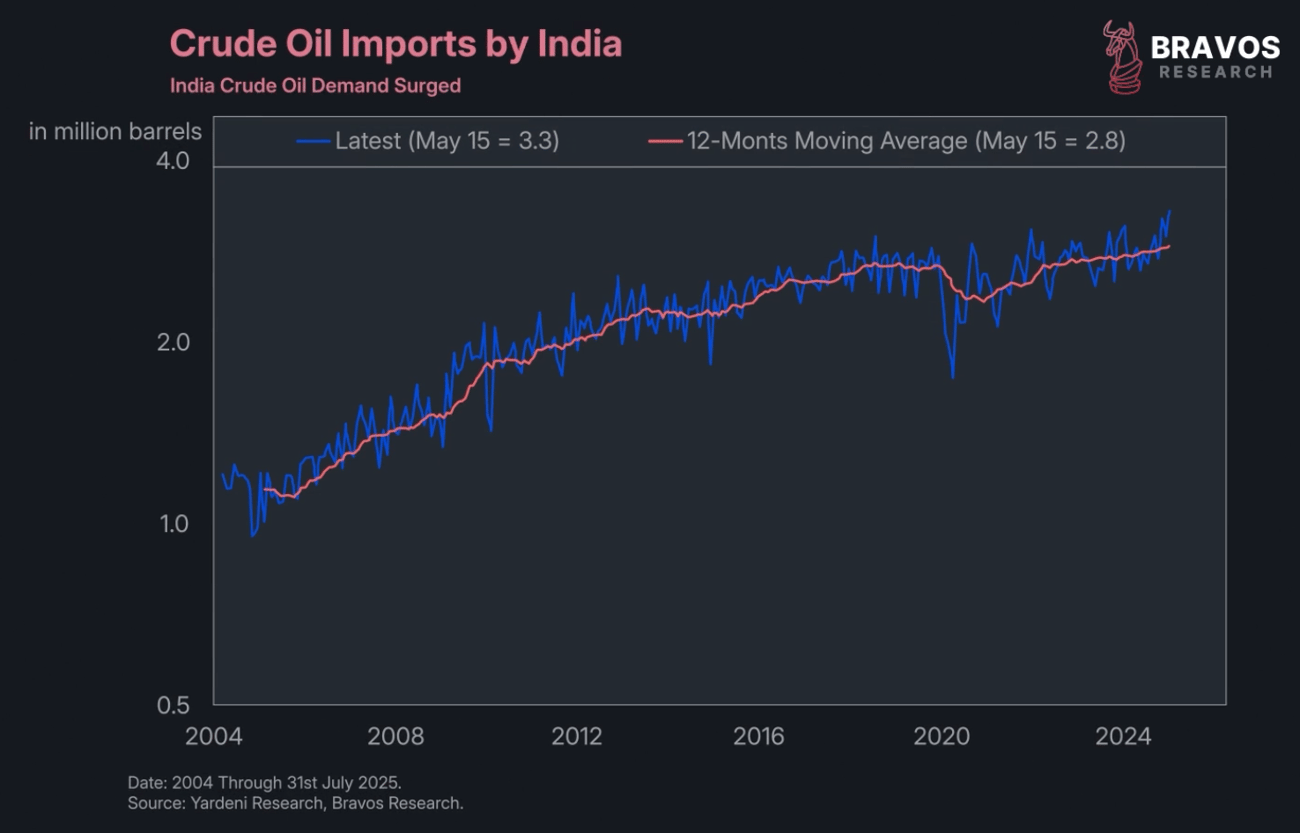

India's oil imports have picked up recently though.

But since India only accounts for roughly 3% of total global demand, it's unlikely to trigger meaningful oil price rises. |

|

|

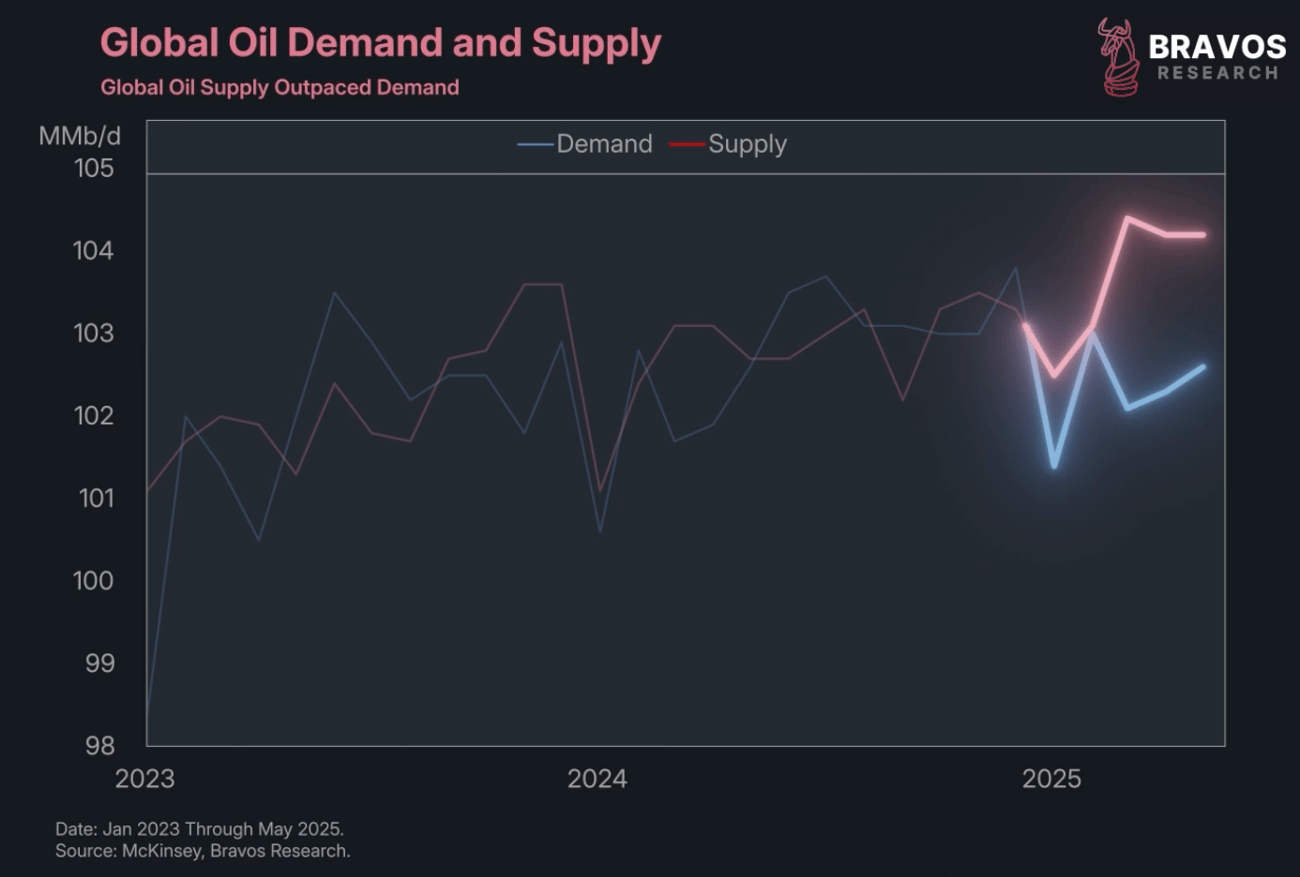

Since the start of the year, global oil supply has outpaced demand, keeping oil prices low.

With the United States producing a record amount of oil and the US economy that's currently cooling, we don't think that this situation is going to change. |

|

|

So, shelter prices are going down, energy and food prices are going down.

That only leaves core goods and services.

By the way, both of these categories contributed to higher levels of inflation in 2021 and 2022.

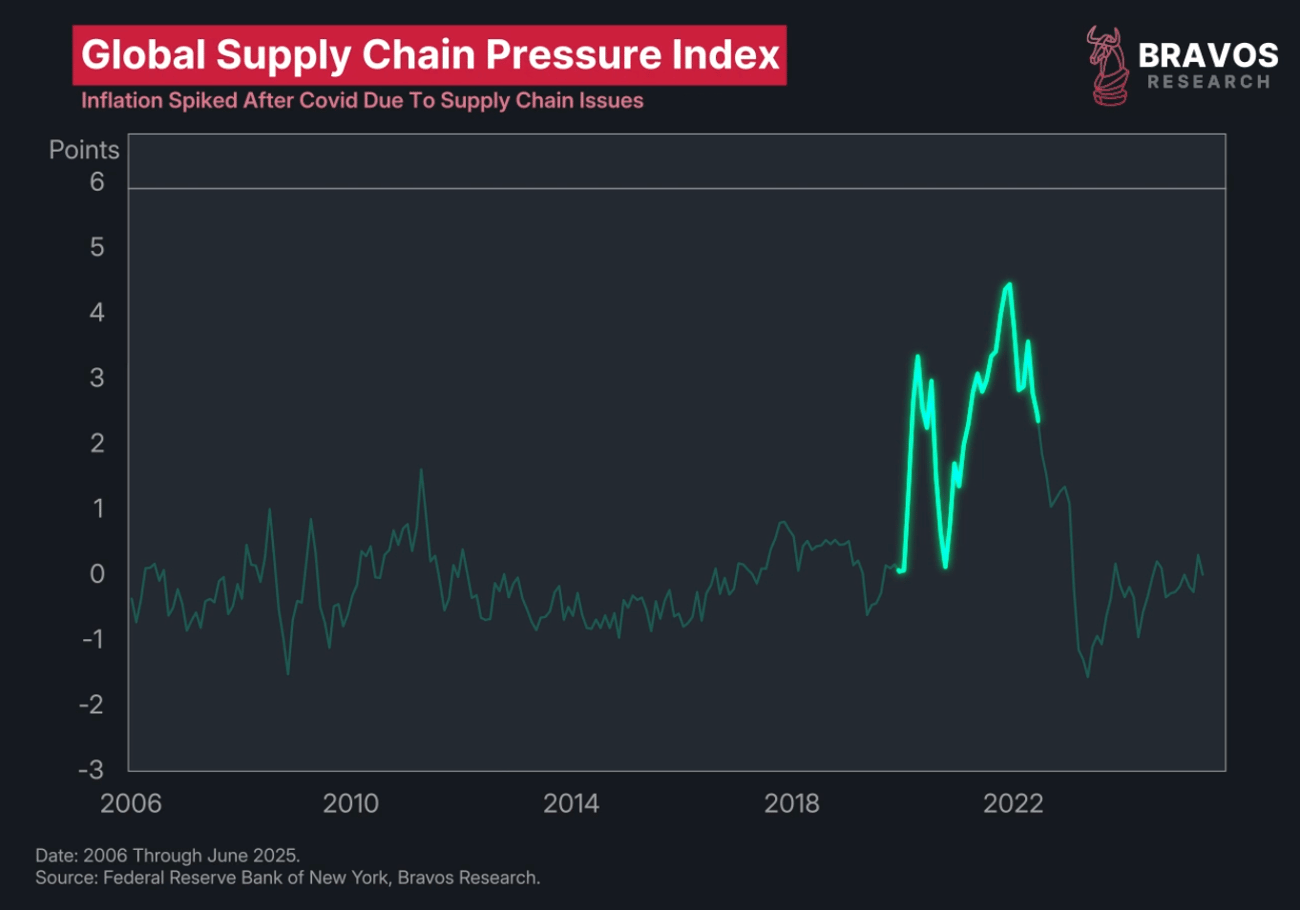

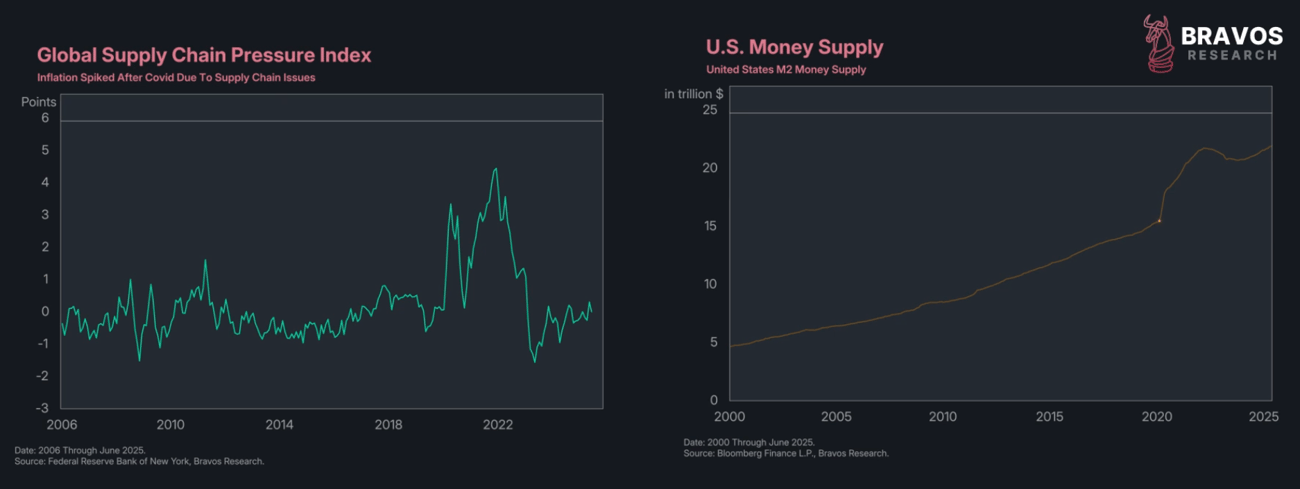

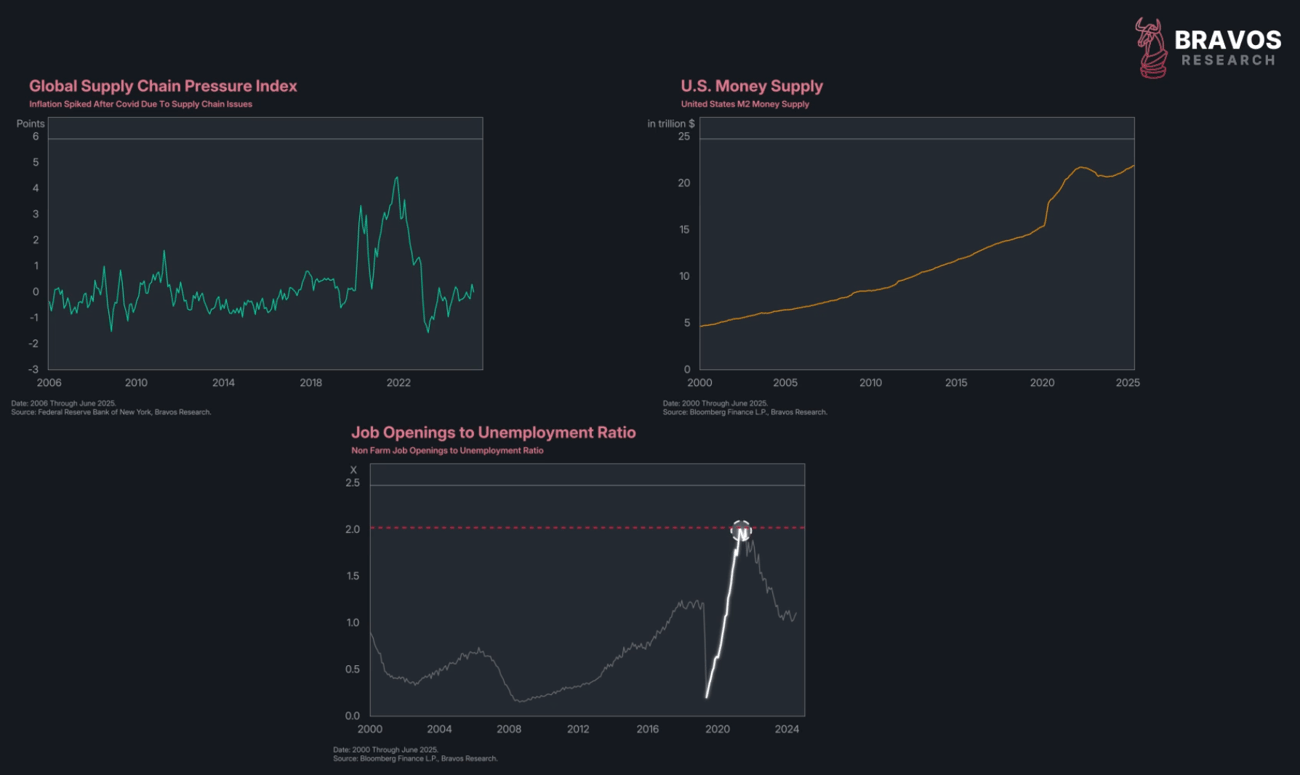

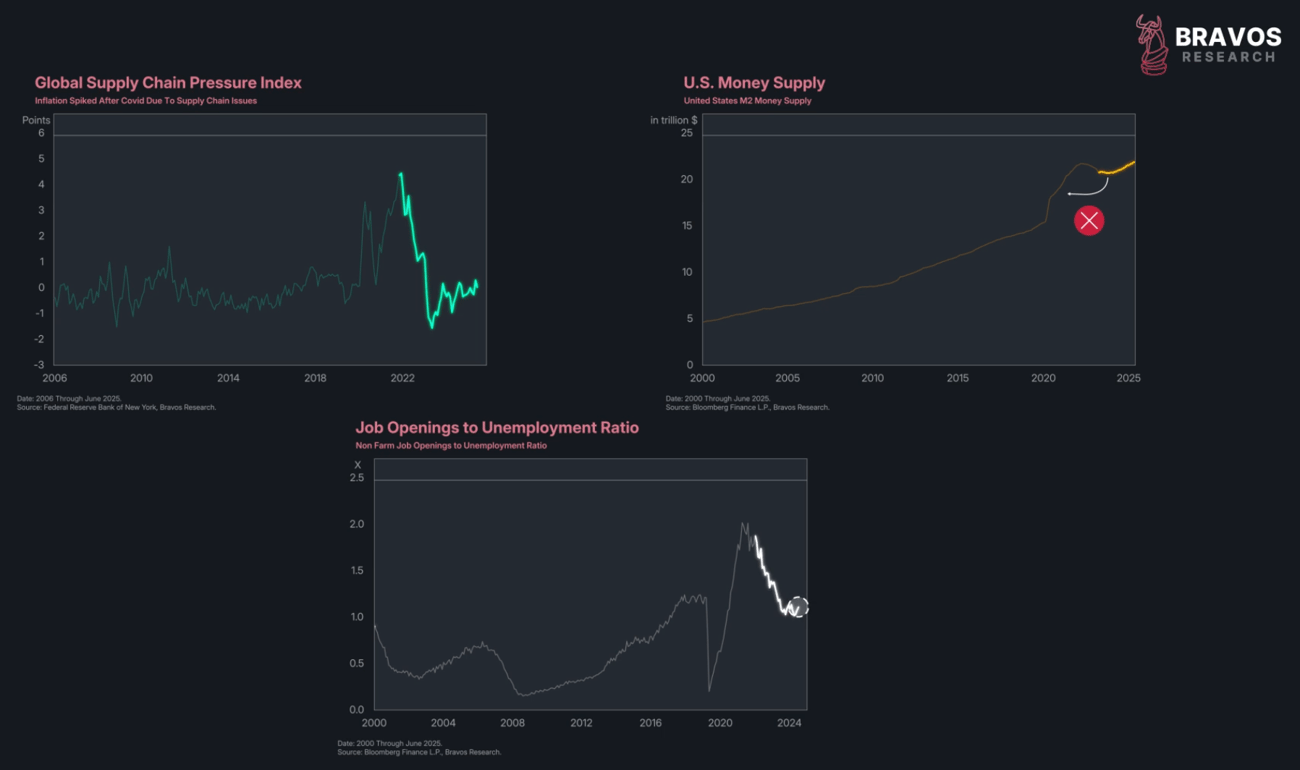

Back then, we had a combination of supply chain problems stemming from Covid that were putting upwards pressure on consumer prices. |

|

|

At the same time, the government was injecting trillions of dollars into the economy during lockdowns.

We can see that from this huge jump in the United States money supply in 2020. |

|

|

And finally, there was a historically tight job market with an extremely elevated number of job openings relative to the number of people unemployed.

This put significant upwards pressure on wage growth and contributed to the rising price of consumer goods and services.

|

|

|

Today, none of the typical inflation drivers are present.

Supply chain problems are virtually non-existent.

Money supply growth has slowed dramatically.

The job market has cooled down substantially.

So why are we expecting consumer prices to go up?

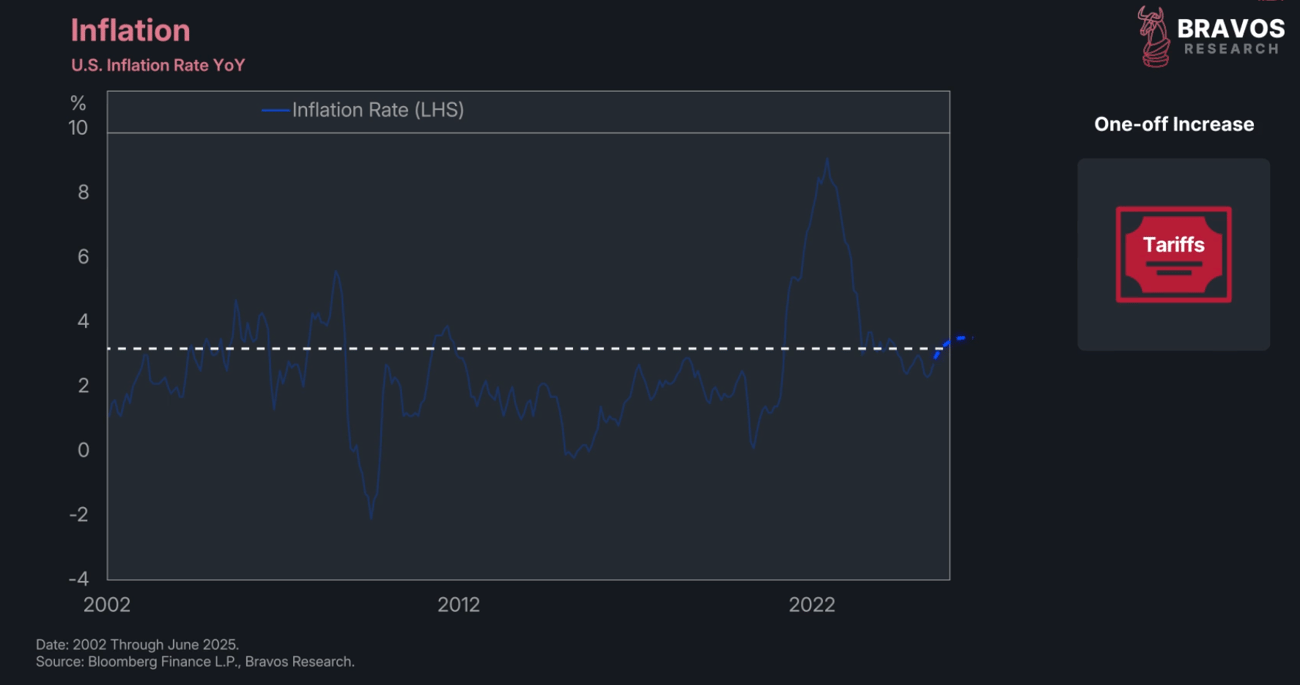

The answer is tariffs. |

|

|

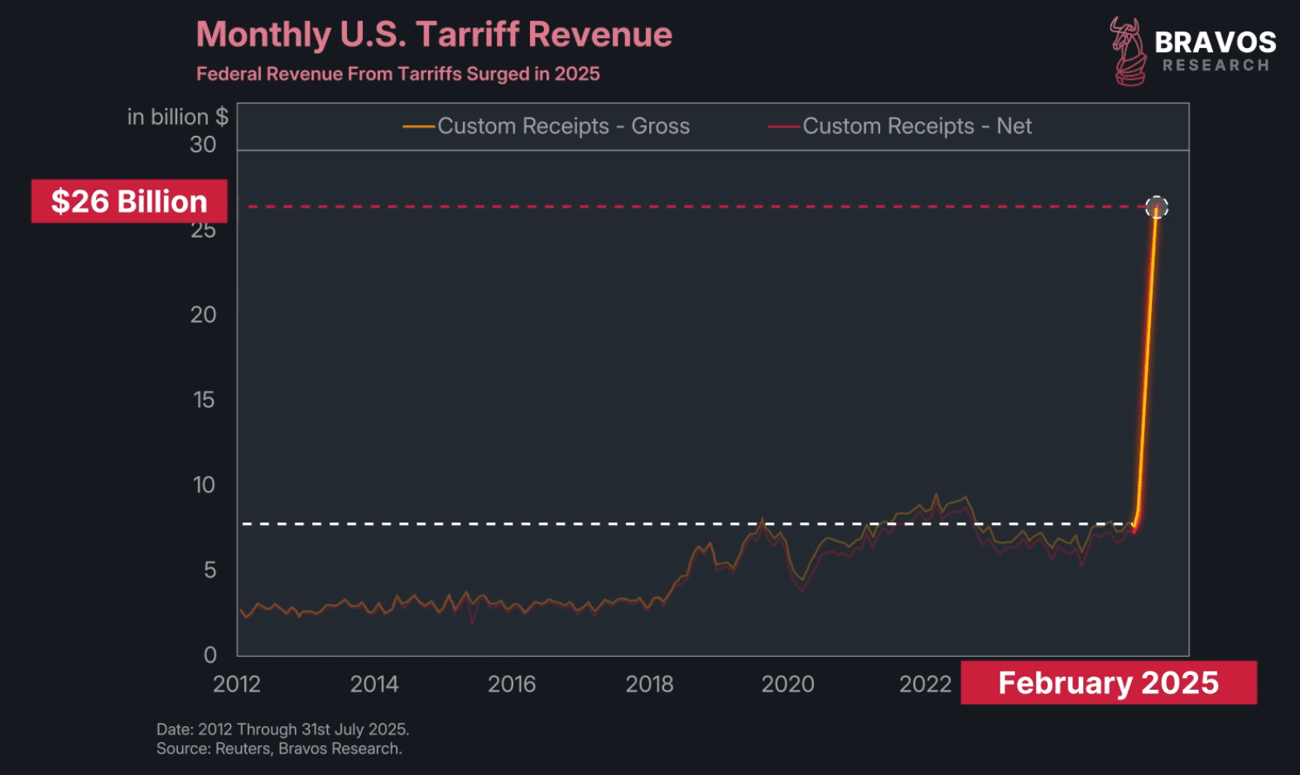

Since February 2025, federal revenue from tariffs has more than tripled, rising from $7.7 billion to now $26 billion.

Although tariff impacts haven't reached consumers yet, we think they're about to. |

|

|

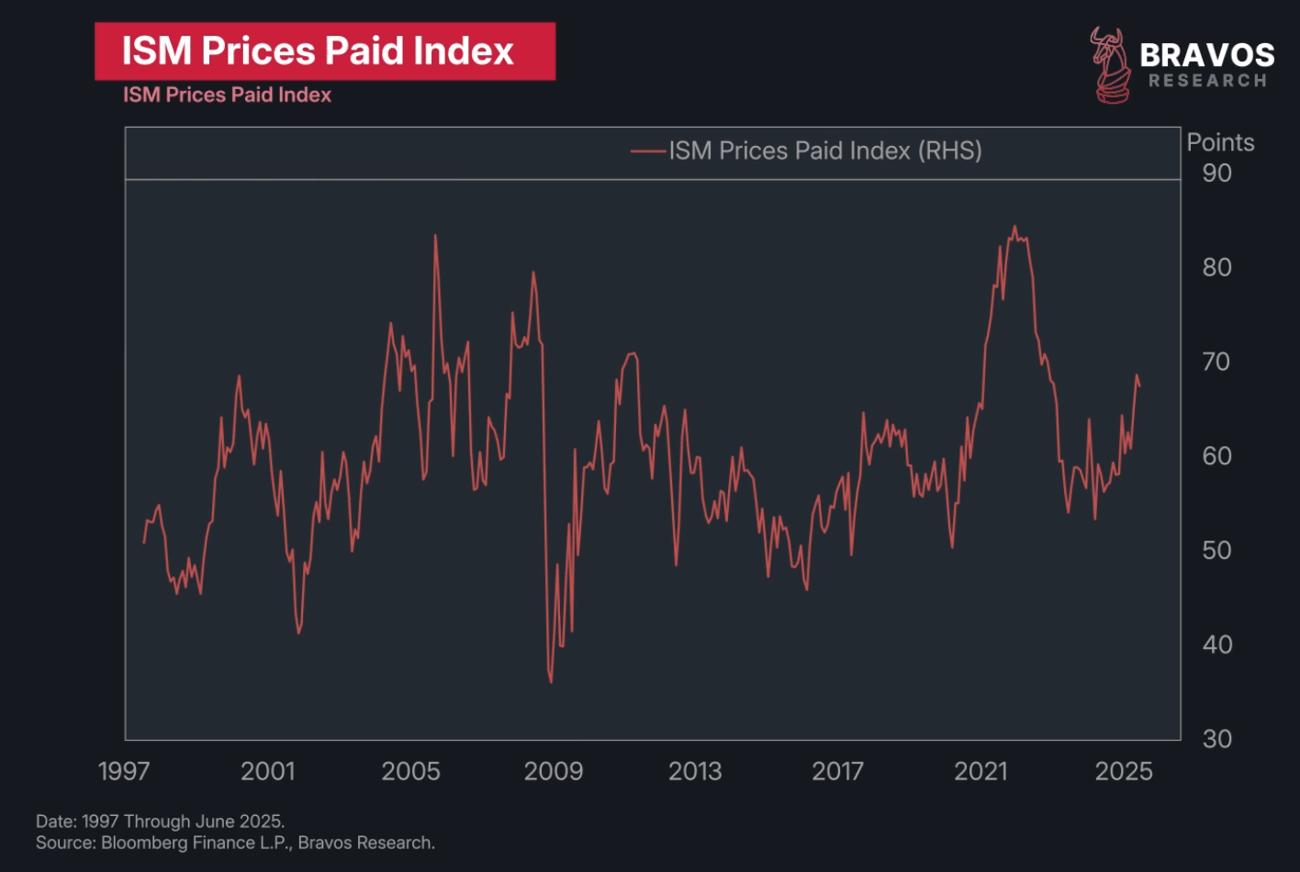

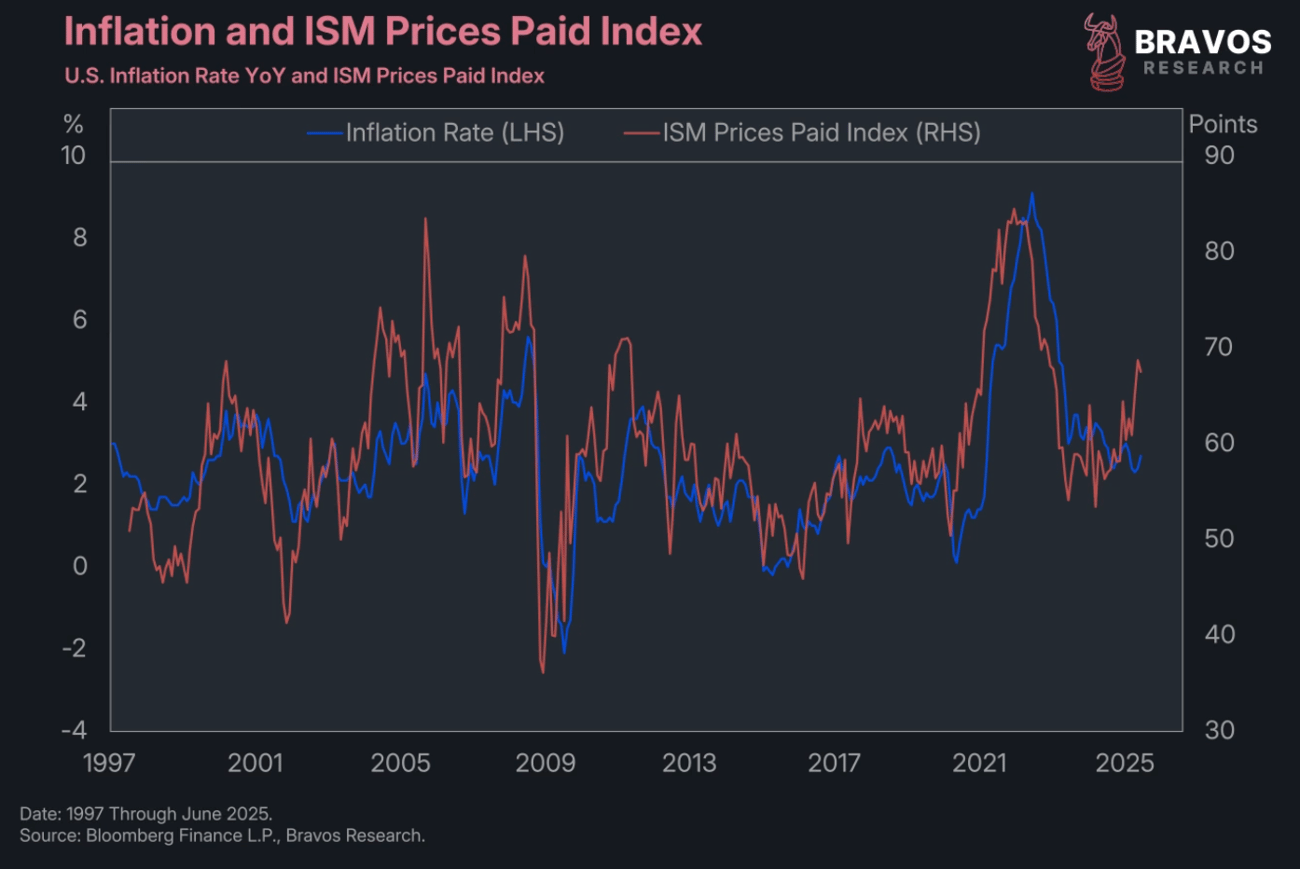

The ISM prices paid index reflects how much businesses are paying for their inputs.

Over the past few months, businesses have been paying significantly more.

Much of this has been driven by tariffs. |

|

|

When we overlay the US inflation rate on top of the ISM prices paid index, this is a very reliable predictor of where inflation is going next.

This is simply because businesses eventually pass on rising costs to consumers.

That's why there's a risk of the inflation rate turning back up, at least temporarily. |

|

|

To be clear, we don't think we're in another 1970s scenario.

Inflation is not heading back to 10%, given everything discussed.

But it is possible that inflation picks back up above 3% by the end of this year and that will impact financial markets. |

|

|

The US Treasury bond market could be especially vulnerable to this temporary inflation pickup.

Now, given the nature of tariffs, this will be temporary.

After all, tariffs are a one-off increase.

They're not an organic source of higher inflation.

Ultimately, we think inflation will head back down after this temporary bump, which would benefit the stock market. |

|

|

Our goal is to provide access to profitable trade ideas to as many people as possible.

We've successfully navigated these markets in the past year:

- 129 total trades completed

- 85 winning positions

- 44 losing trades, with controlled risk

We recently booked a 13.95% profit on $ZIJMF and 27.13% on $SMCI.

View our 2024 track record for free on our website here.

Click here to get our complete Trading Strategy and real-time Trade Alerts

|

|

|

|

|

Interested in more insights like these?

This article was originally published on Bravos Research. For more in-depth analysis and exclusive market insights, visit Bravos Research.

Contact us 24/7

Remember, we're here to help. If you have any questions, please contact us.

Warm regards,

The Bravos Research Team |

|

|