|

Why Recession Fears are Missing the Bigger Picture |

|

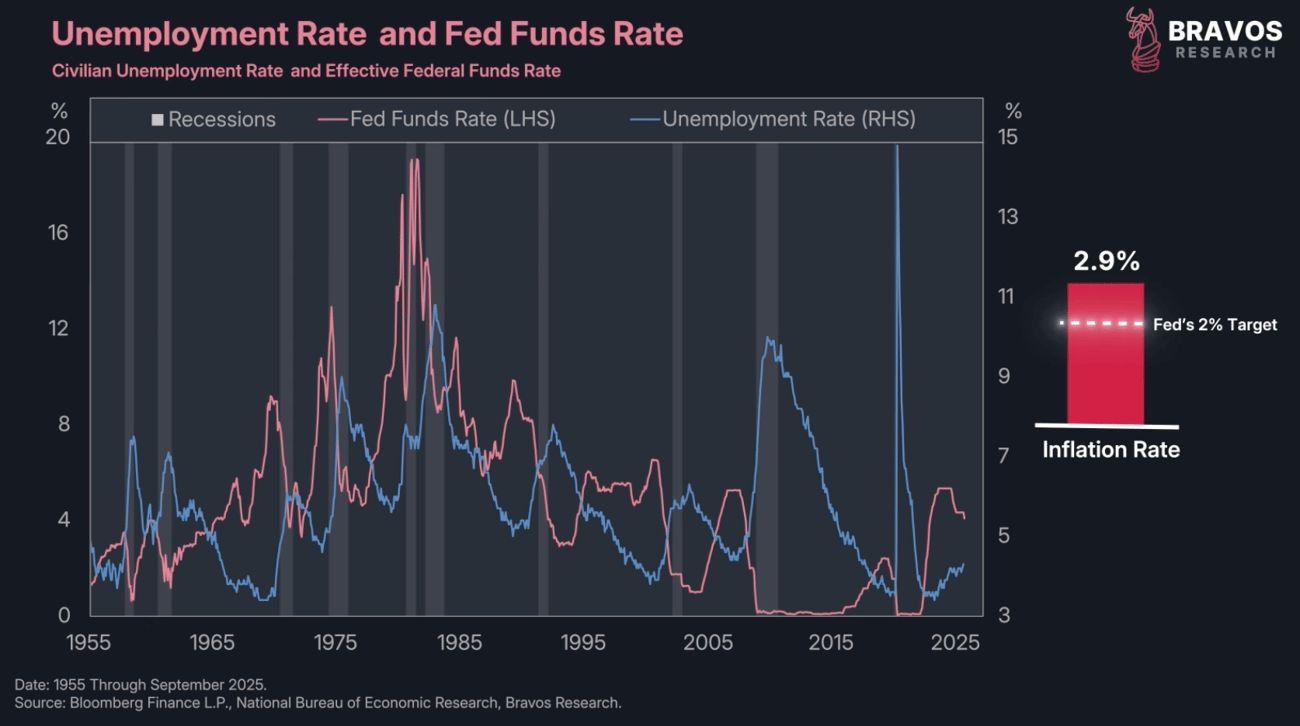

The National Bureau of Economic Research has a very specific definition of what they classify as a recession.

According to their definition, the very first determining factor is unemployment.

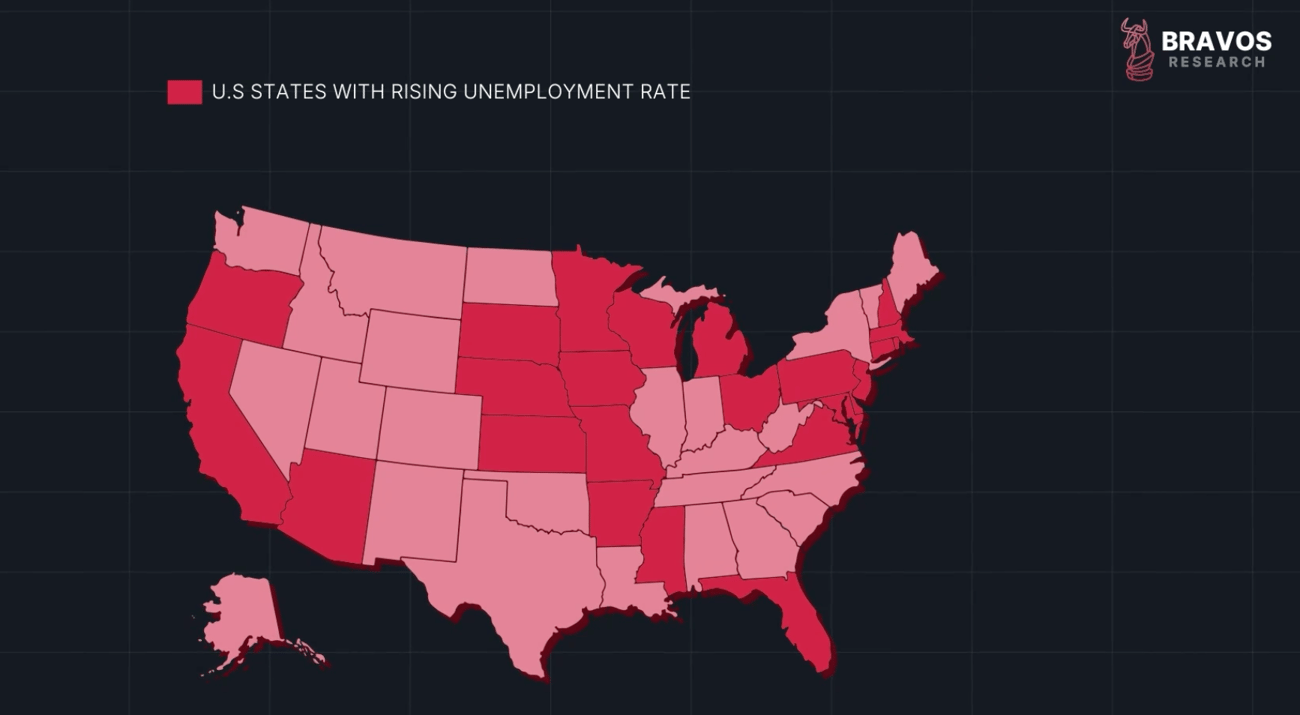

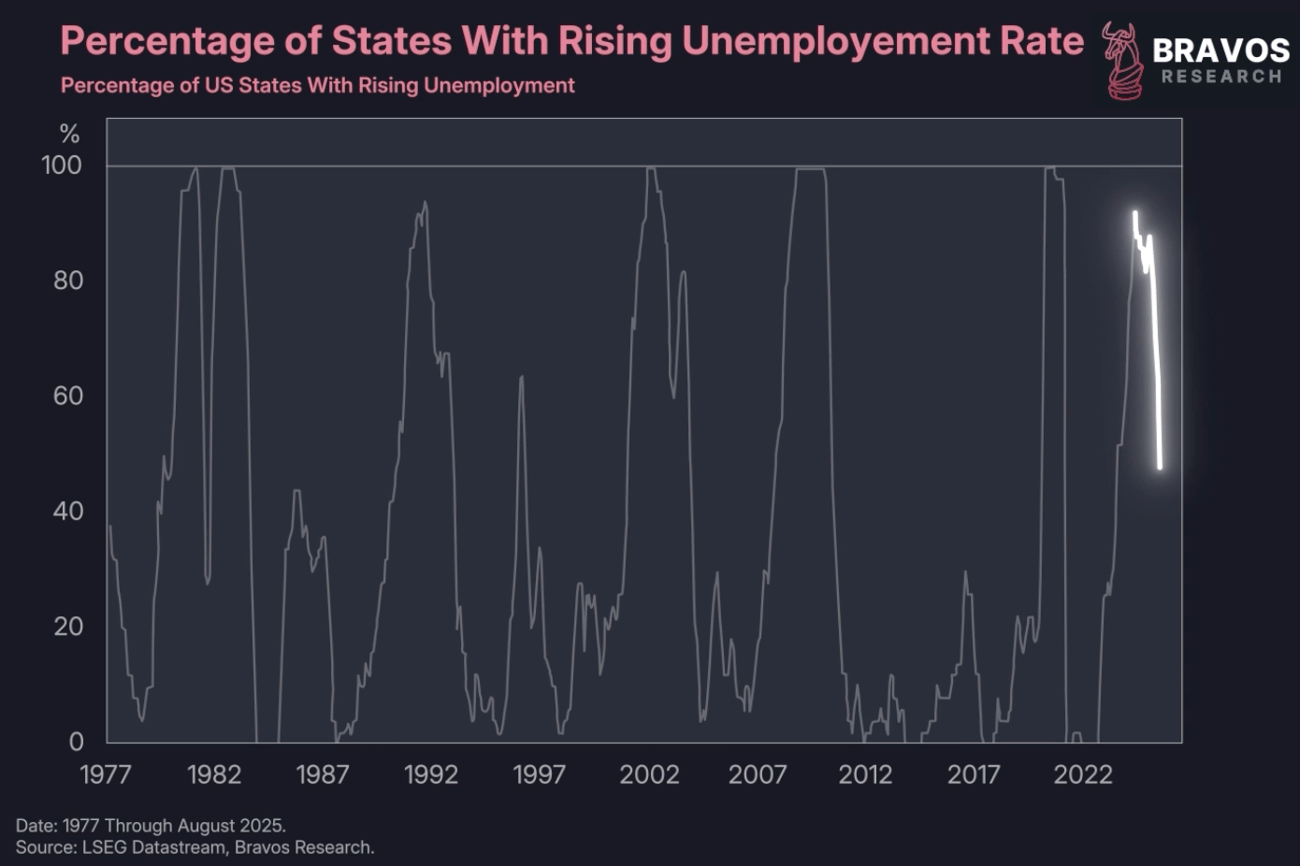

Currently, 25 states across the US have a rising unemployment rate.

This is something we haven't seen since 2020 and before that 2009. |

|

|

|

|

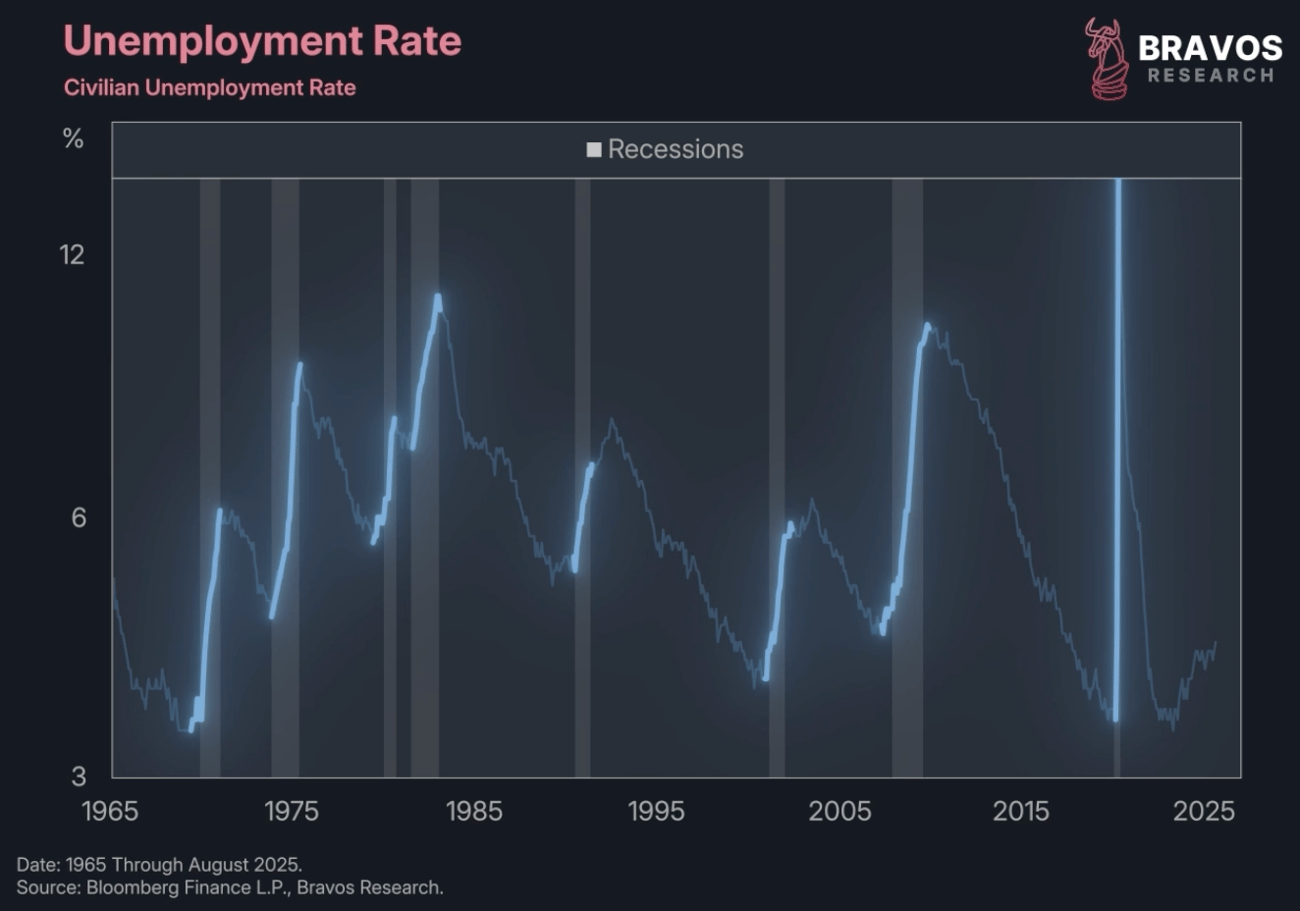

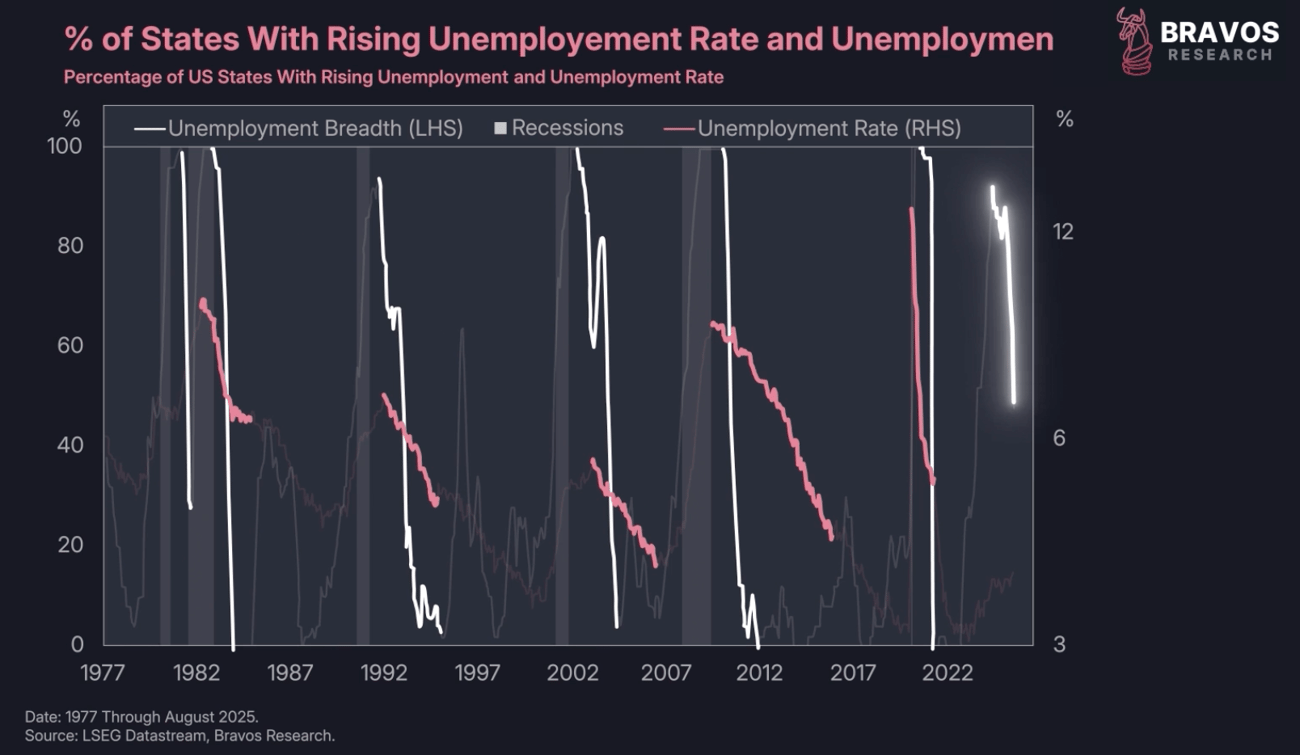

Over the last 2 years, the national unemployment rate has gone from 3.4% to 4.3%.

Going back to the 1960s, we've never seen the unemployment rate rise by almost 1% without the NBER classifying it as a recession.

So why has the NBER not signaled the start of a recession and could they be about to? |

|

|

🎉 30% Birthday Discount - Deal Expires in 24 Hours!

|

|

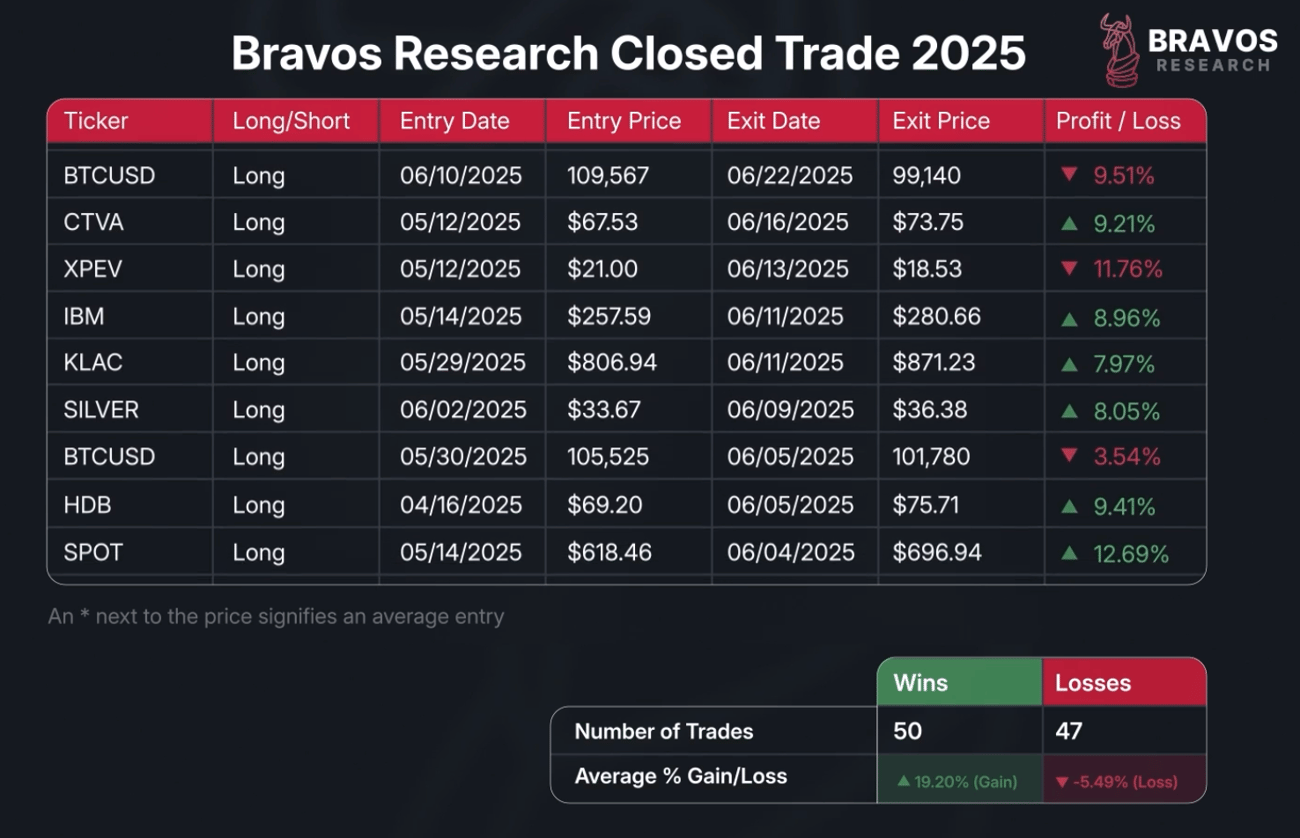

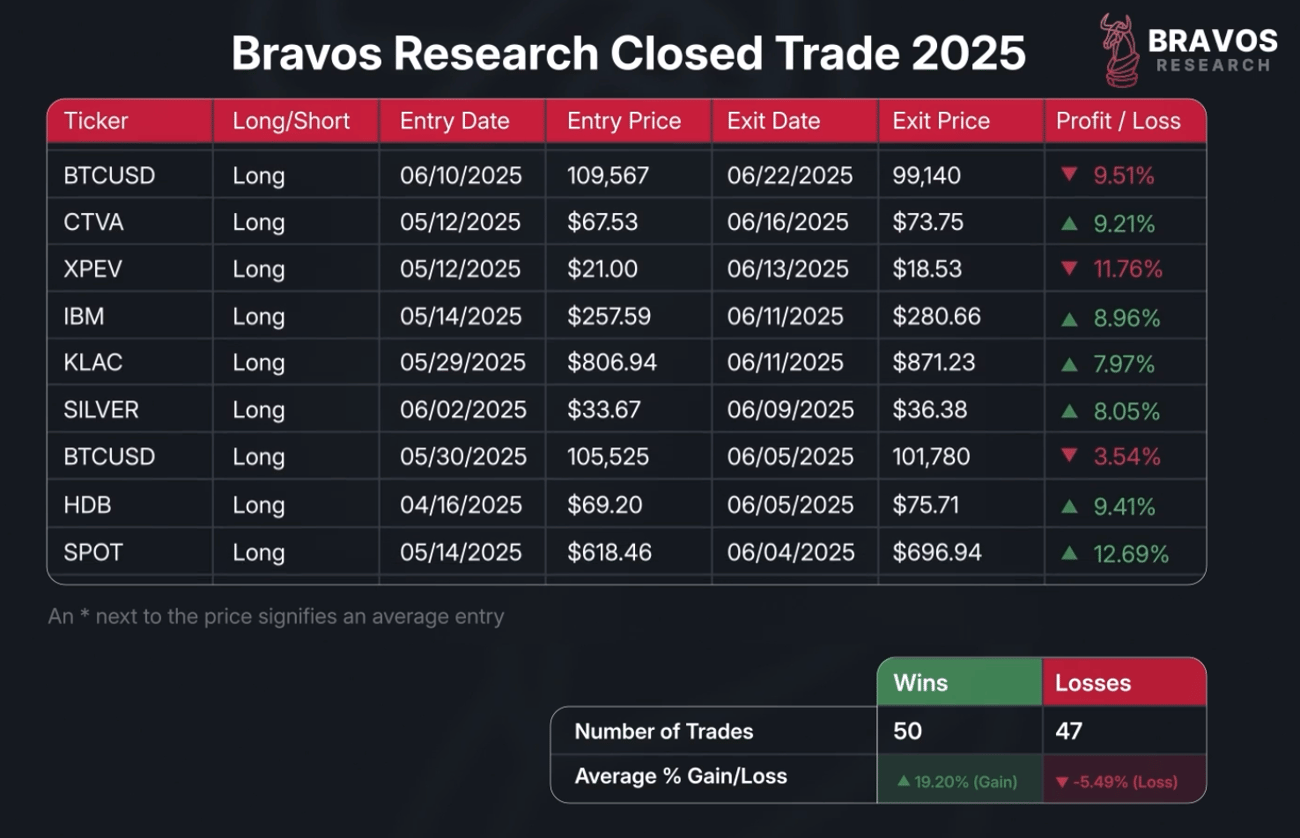

This is your last chance to secure one of our biggest discounts of the year.

Get a full year of premium membership for a fraction of the usual price.

We take you through our trading strategy step-by-step and send you real-time Trade Alerts.

- Just booked +26.68% profit on a leveraged gold trade ($UGL)

- Locked in +45.5% gain on a semiconductor stock (ACMR)

- Currently riding multiple positions like Nvidia

Only a few hours left to grab this deal - Click here to join Bravos Research |

|

|

Recessionary Signals are Present |

|

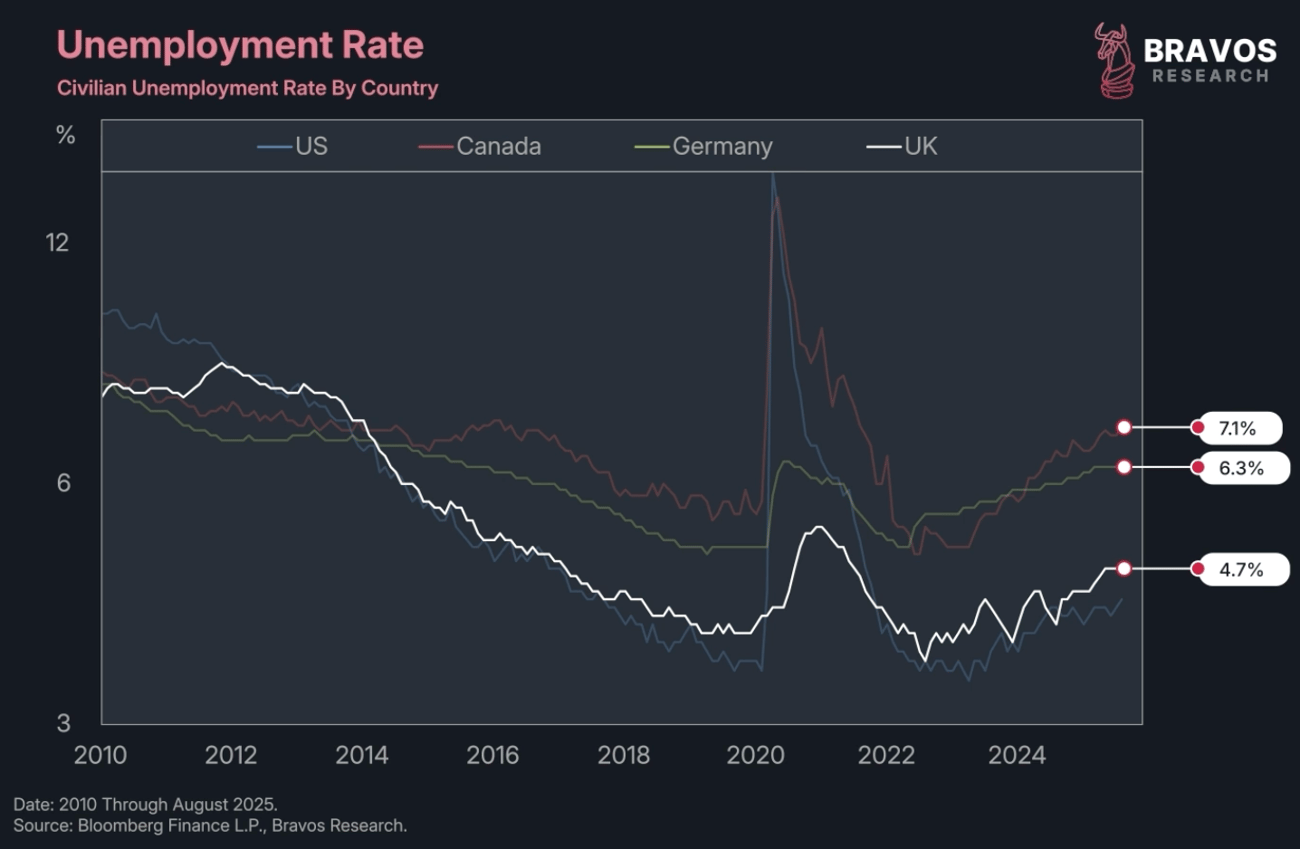

It's not just the US seeing unemployment tick up.

In Canada, unemployment has risen to 7.1%, Germany to 6.3%, and the UK to 4.7%. |

|

|

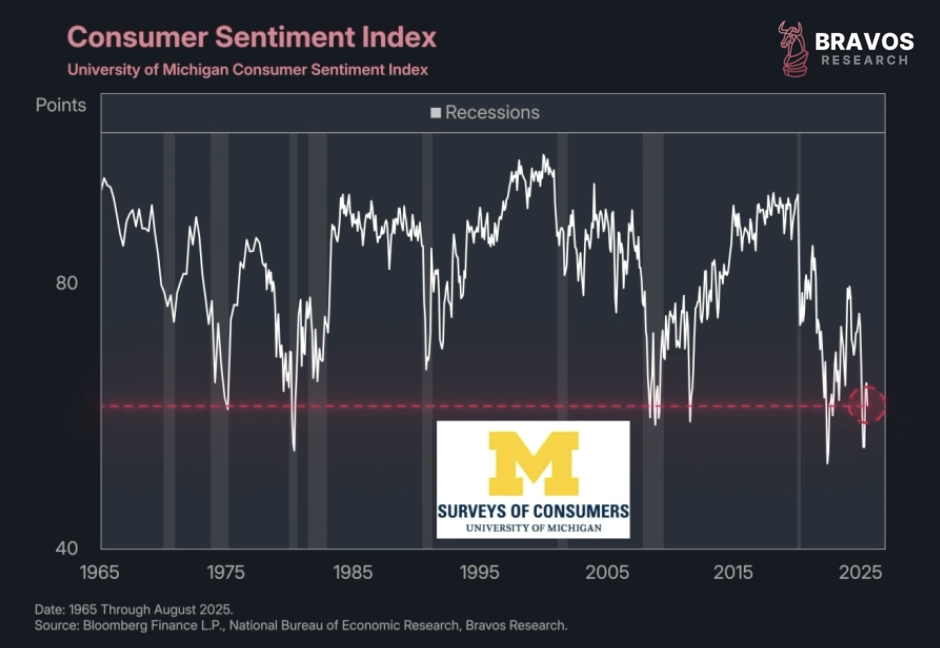

We've also seen other very typical recessionary signals over the last year.

Consumer confidence in the US is currently at levels that have only been seen during the worst economic downturns in history. |

|

|

We also saw a bear market in stocks in early 2025.

The average stock dropped 35% during this market decline, which is what can typically happen during a recession.

|

|

|

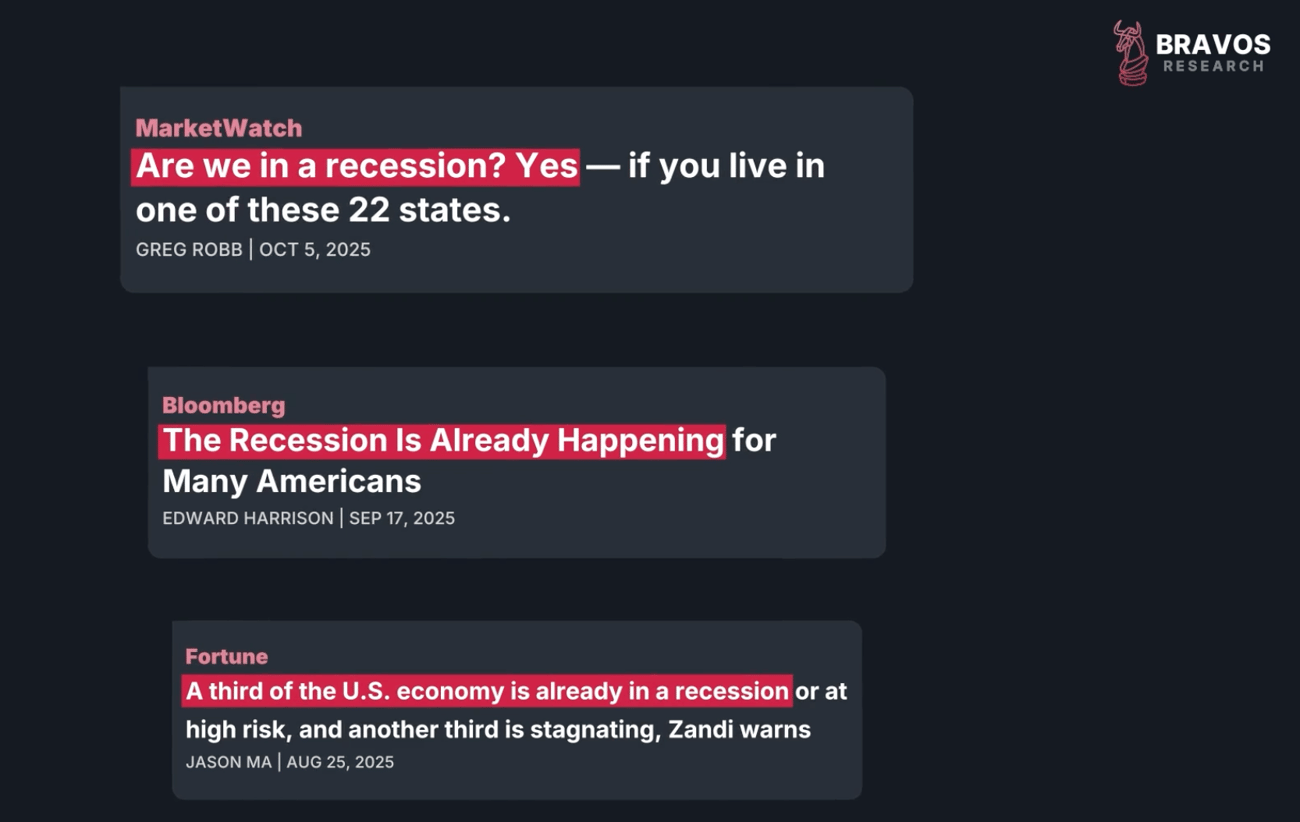

All of these data points have pushed many economists to say that we've been experiencing a recession, that the NBER is just too slow to react.

Indeed, historically there is a 7.8 month lag between the start of a recession and the moment where the NBER announces it.

Many speculate that we're currently in that period, but let's look at the other 3 factors on the NBER's list. |

|

|

The Other 3 Factors |

|

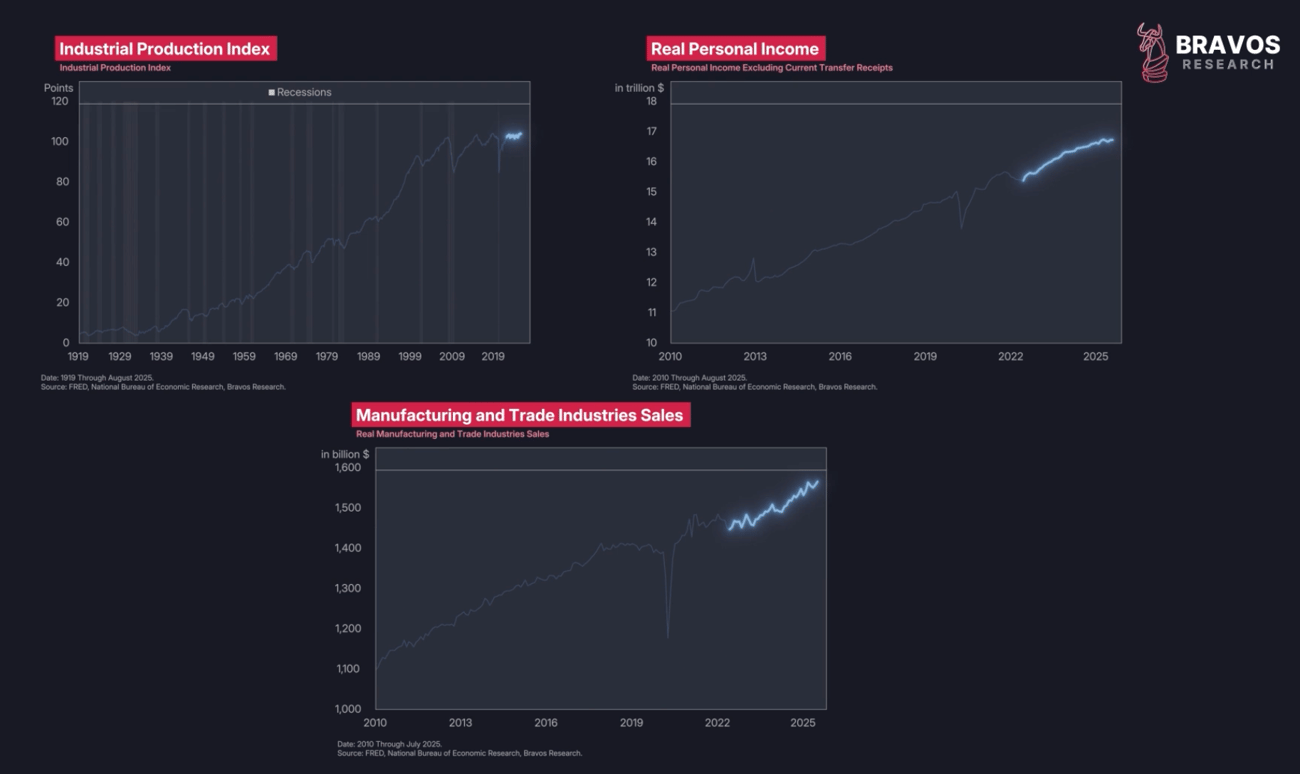

Industrial production has flatlined since 2022, but has not contracted as typically witnessed during recessions.

Real personal income has kept growing at a steady pace throughout 2024 and 2025.

And the volume of sales in the manufacturing and trade sectors has actually picked up recently.

These 3 other metrics are all practically at all-time highs, not exactly what you would expect during a downturn. |

|

|

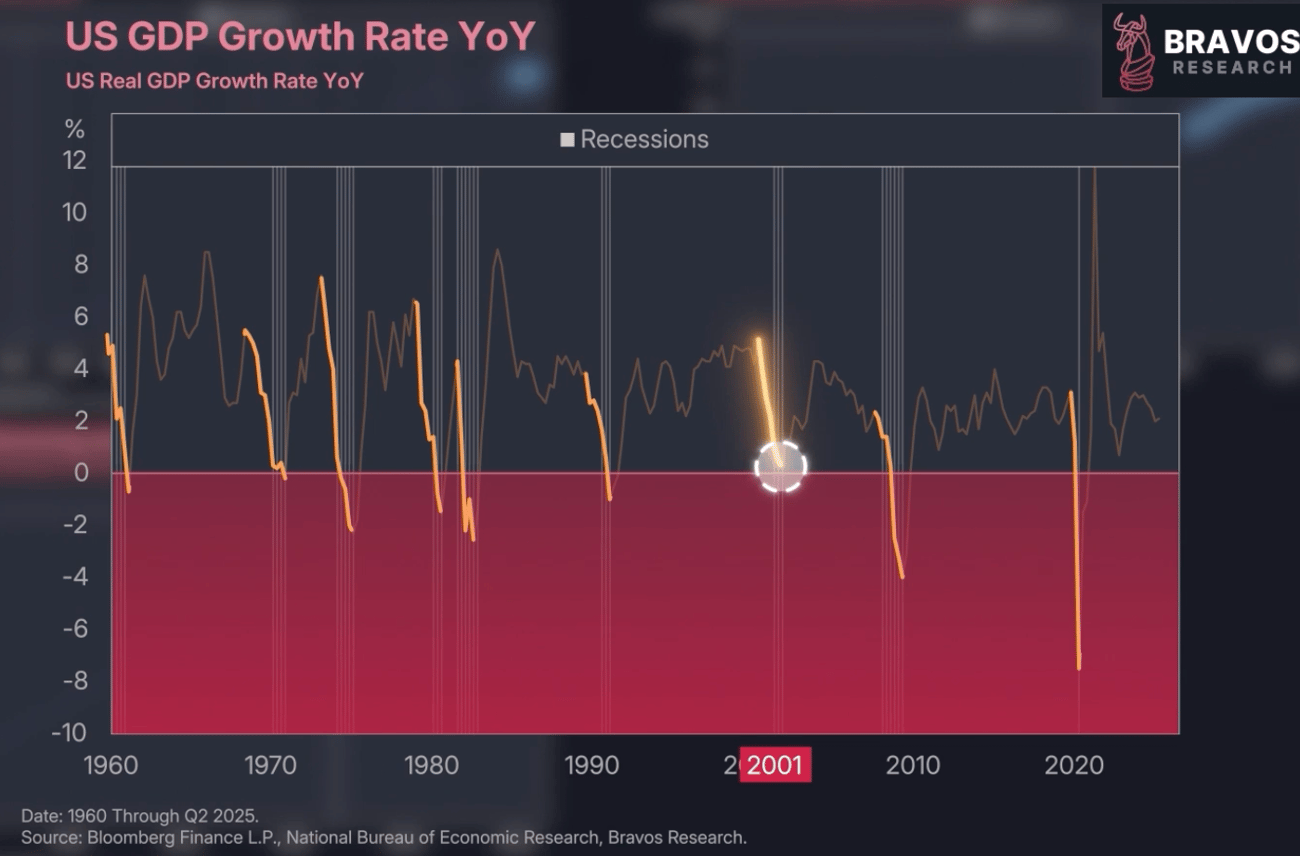

US GDP has also continued to hover between 2 and 3% for the last few years, never dipping below 0 into contraction.

Most recessions were marked by GDP contracting on a yearly basis.

The one exception was in 2001 when the economy slowed, but GDP never contracted.

So for now it seems quite unlikely that the NBER would label this as a recession just based on the unemployment rate rising. |

|

|

But that doesn't mean we can't quickly get there.

After all, if 25 states are seeing job losses, we should expect these metrics to begin rolling over, right?

Again, this requires nuance. |

|

The State-Level Picture |

|

This chart shows the percentage of states that have a rising unemployment rate.

Right now, this percentage is actually declining.

So, more and more states are beginning to see their unemployment rate fall back down.

That's the opposite of what we usually see heading into recessions. |

|

|

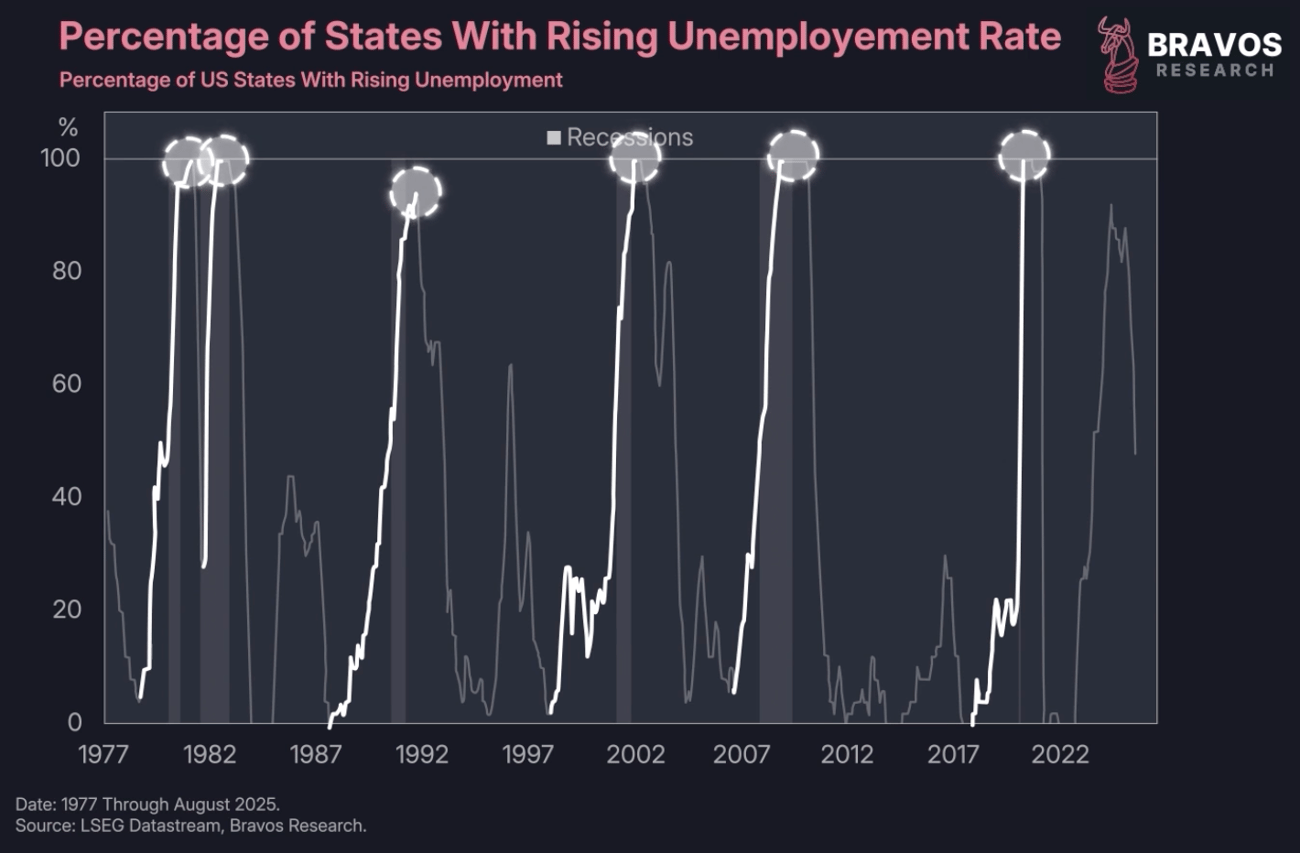

What typically happens is that more states experience a rising unemployment rate.

And the moment where this indicator peaks and begins to come back down tends to coincide with when the unemployment rate begins to fall. |

|

|

What's happening today actually looks more like what occurs after a recession ends, as we saw in 2020, 2009, 2002, and 1991.

All of these were followed by a peak in the unemployment rate and a subsequent decline in the months that followed. |

|

|

The Stock Market Signal |

|

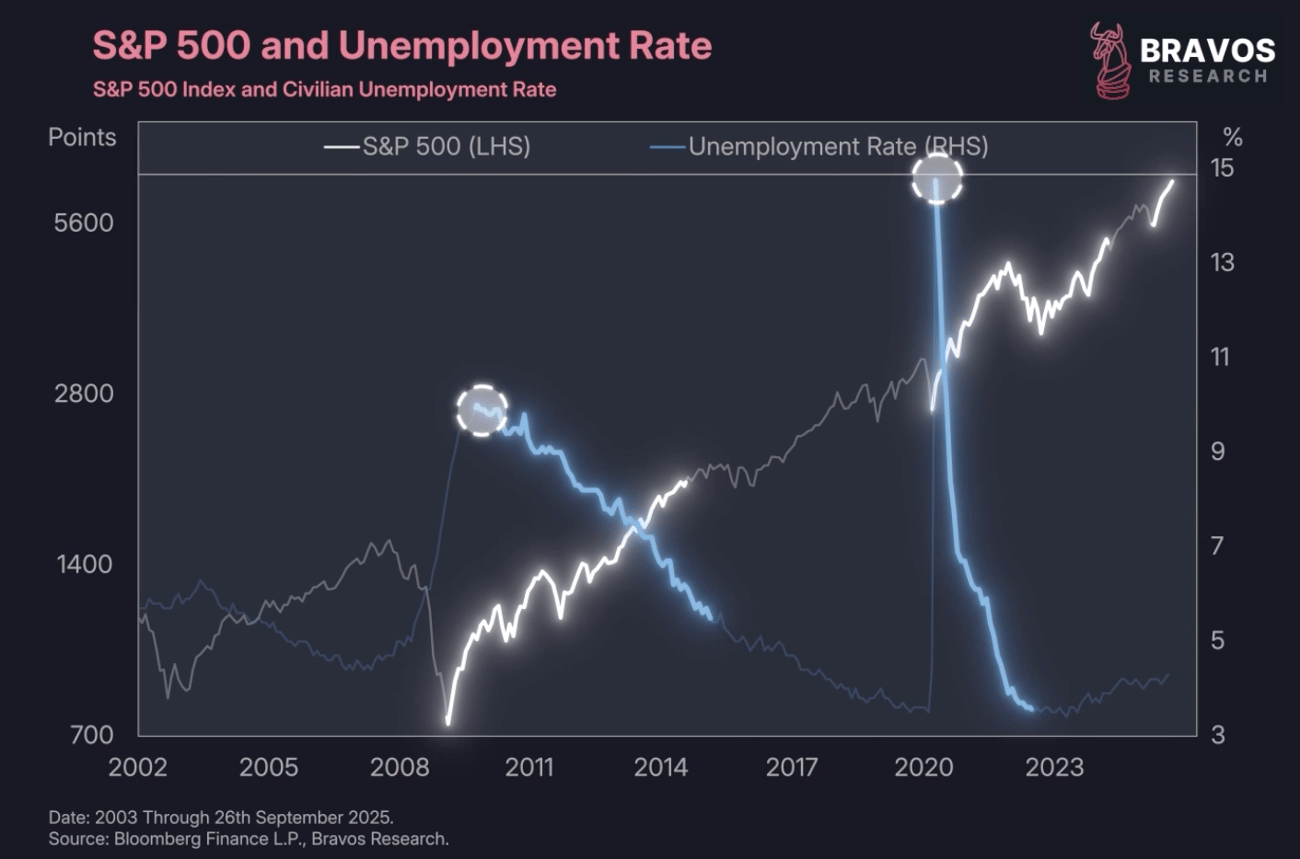

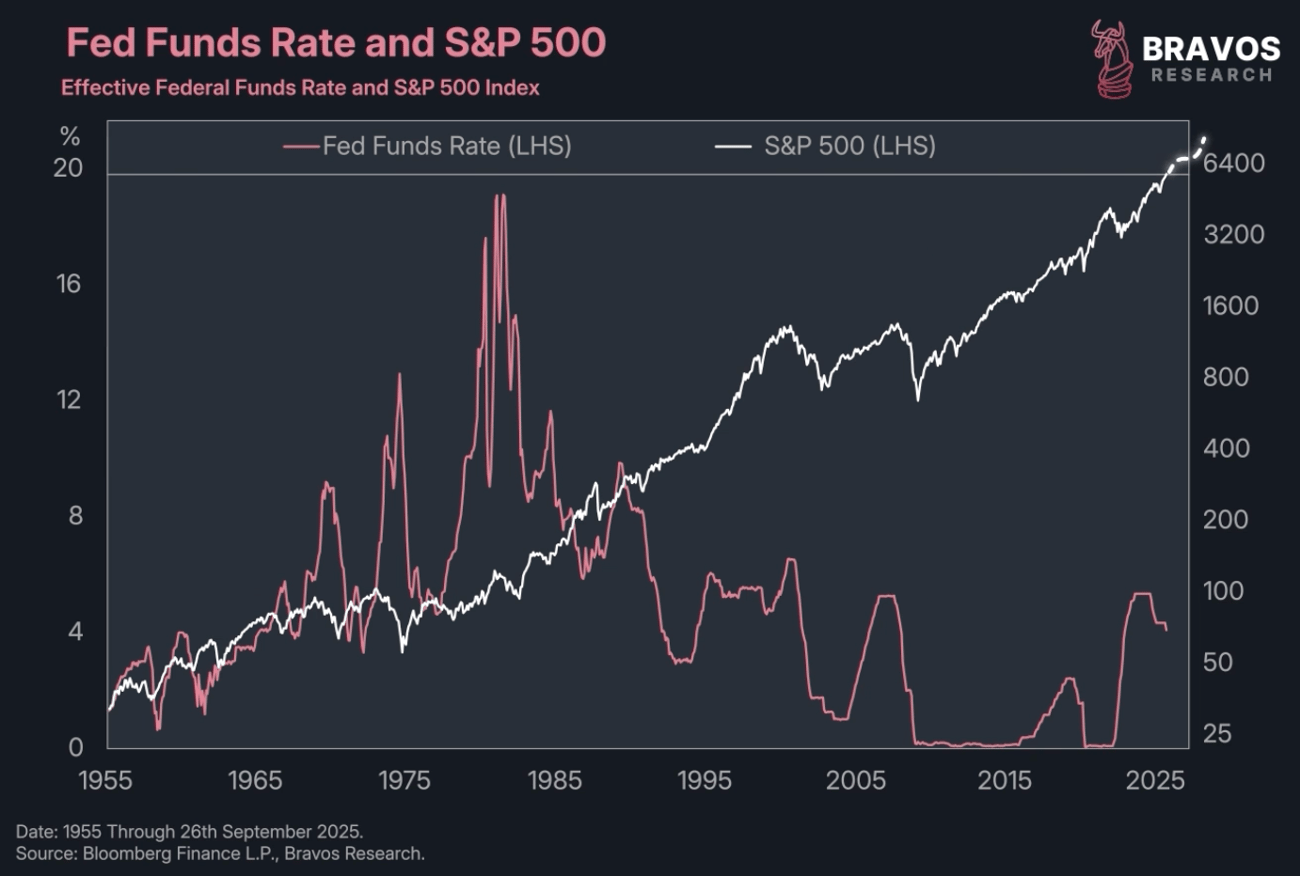

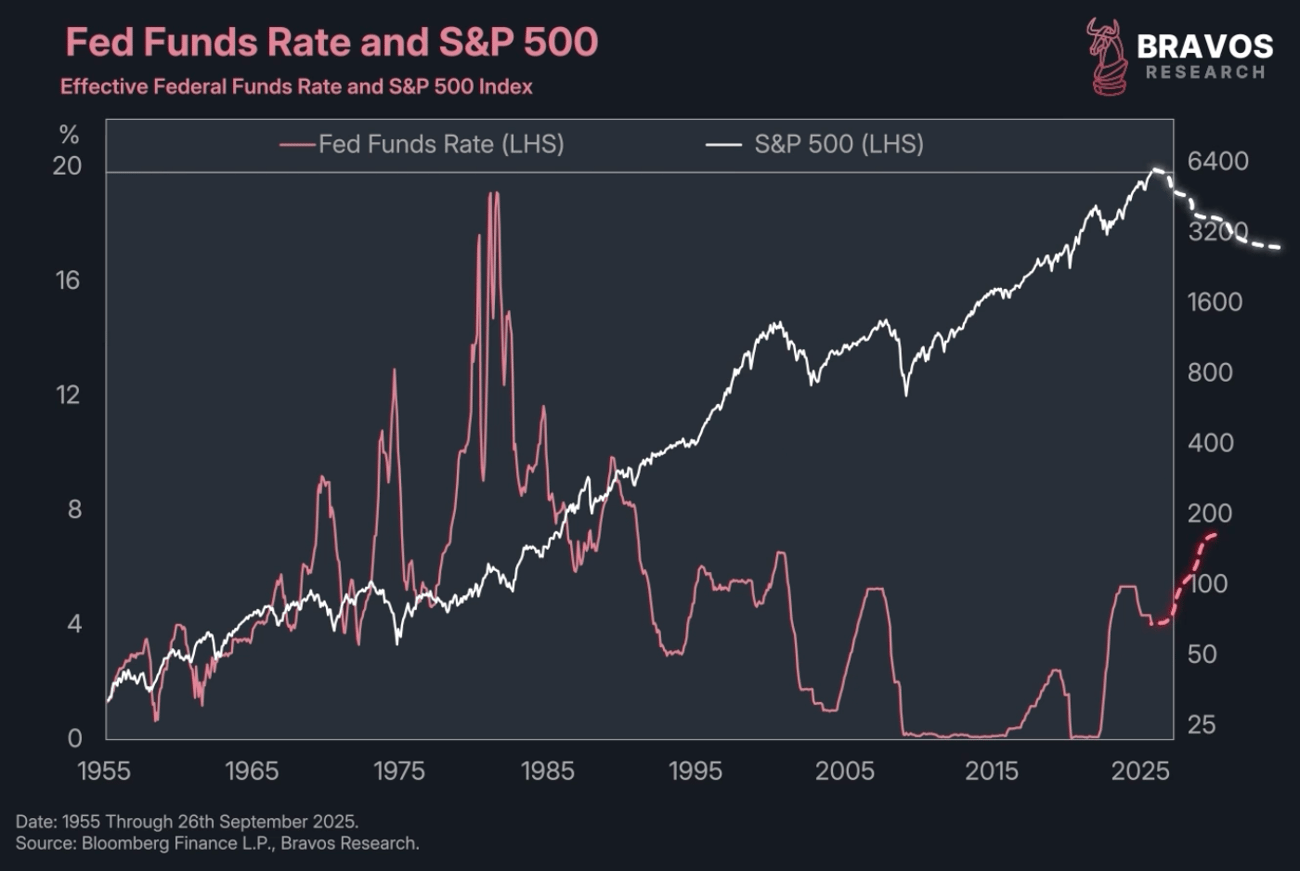

The story fits very well with what we're seeing on the US stock market as well.

It has been on the strongest rally since 2020 and before that 2009.

Both of these rallies occurred right before a peak in the unemployment rate. |

|

|

If history repeats, it would suggest we're embarking on a brand new bull market that could have multiple years left to run.

This is a narrative we're seeing spread on the news and social media right now.

But we think this may be flawed because the recovery we're experiencing is no ordinary one. |

|

|

Why This Time Is Different |

|

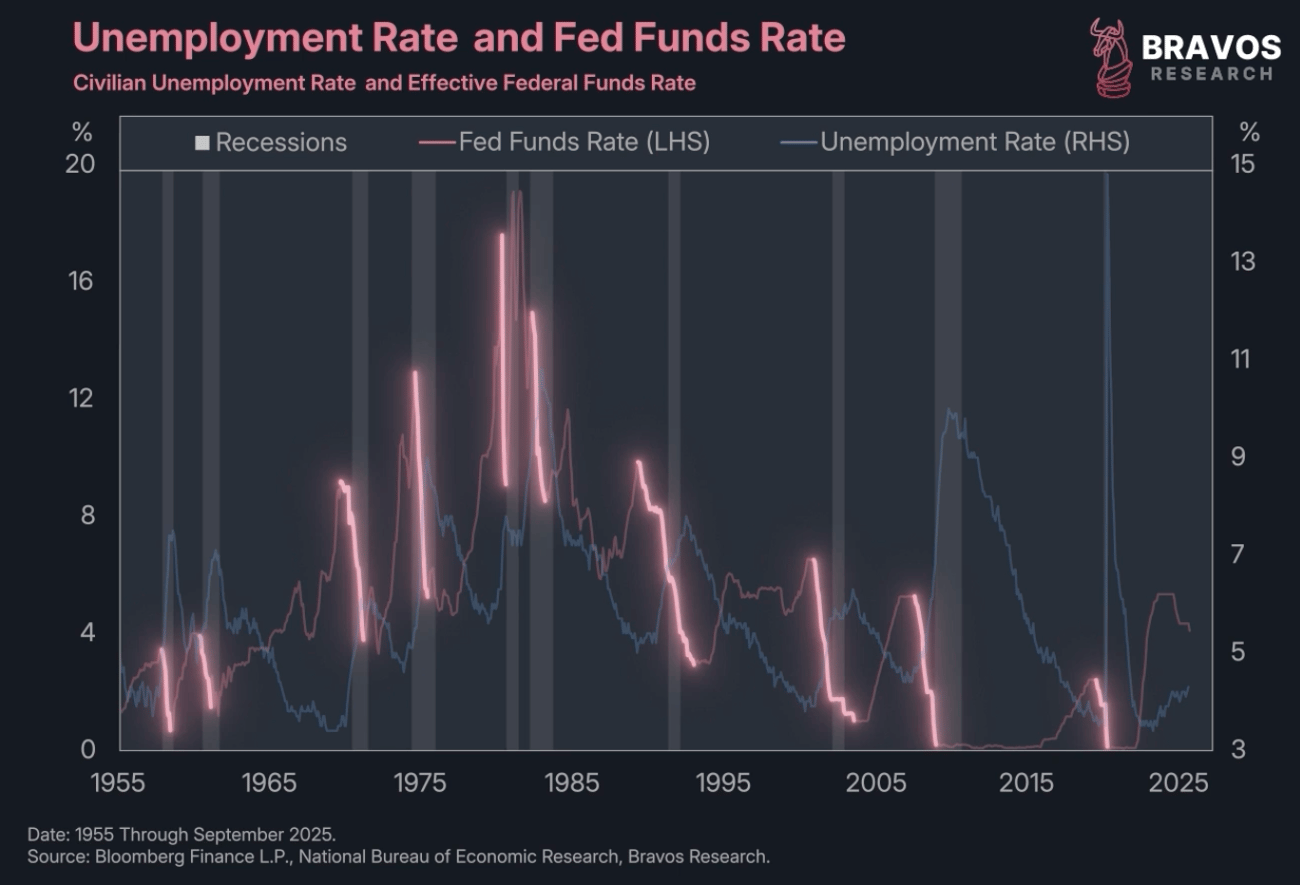

Historically, recessions are marked with an uncontrolled rise in unemployment.

Businesses see earnings collapse and layoffs spike.

This sharp economic pain forces the Fed to cut interest rates violently to stabilize the economy.

As a result, the Fed typically keeps rates low for an extended period.

This allows the recovery to last multiple years and drive the stock market to great heights. |

|

|

Today, the situation is quite different.

The rise in unemployment has been very steady and controlled, and we've not witnessed a complete break in the labor market like in a typical recession.

This also means the response from the Fed has been a lot more muted and controlled. |

|

|

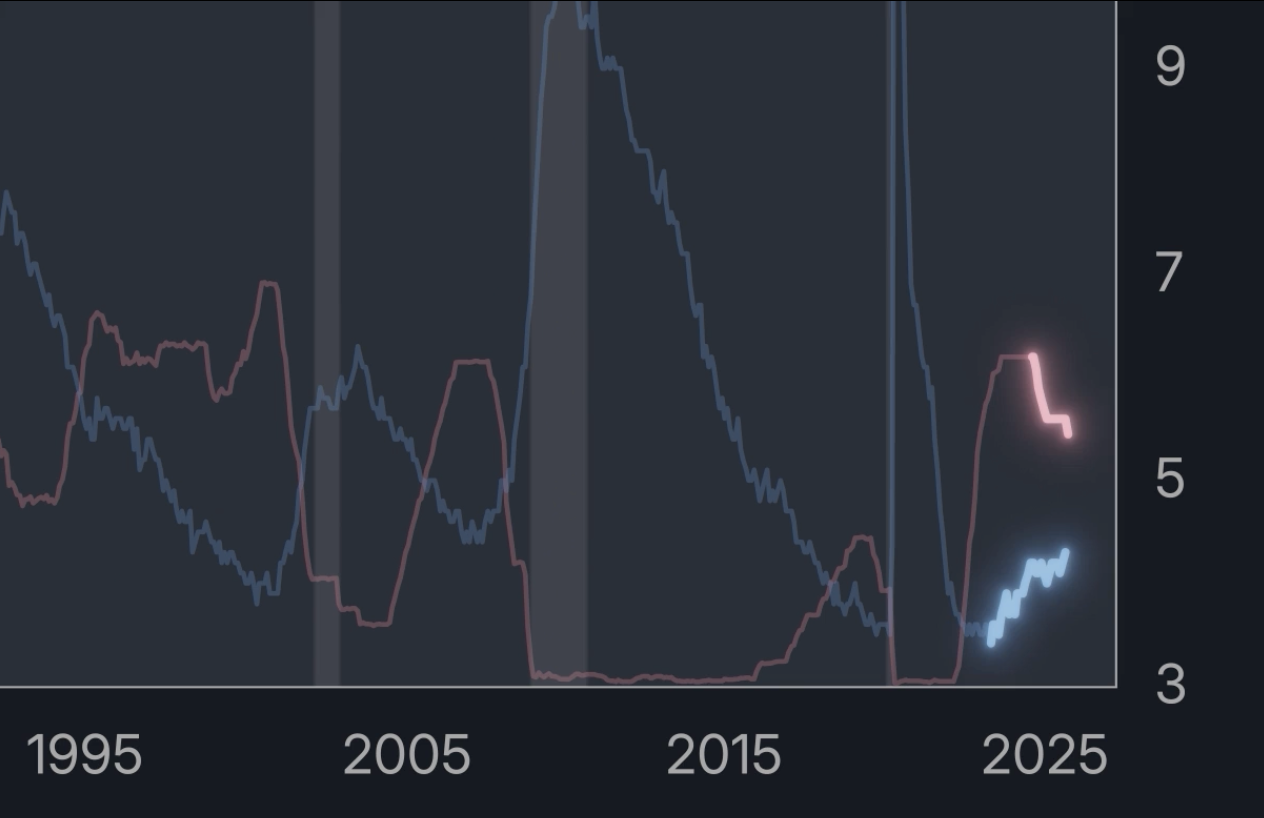

We've seen the Fed thoughtfully lower interest rates as unemployment has risen.

If unemployment were to turn back down, it's likely that the Fed would stop lowering rates and depending on inflation, they could even consider raising rates again.

Inflation in the US is still running above the Fed's 2% target, so this is quite a reasonable scenario. |

|

|

For now, this is not the case though.

The Fed is cutting interest rates and is projected to continue doing so in response to rising unemployment.

This is why we actually think that the stock market could have more room to run in the coming months.

But things could change very quickly.

|

|

|

Calling this a brand new bull market or even worse, a new multi-year economic recovery is quite a stretch.

The Fed could quickly turn their monetary policy around and stop this recovery dead in its tracks.

That's why we believe the Fed is the single most important factor to watch in today's market.

And we're adapting our level of aggressiveness depending on what we believe they're likely to do next over the next few months. |

|

🚨 30% Discount Offer Ends in 24 Hours |

|

Secure a membership to get access to:

- Our entire trading strategy

- Real-time buy and sell alerts for all our trades

- Supporting data and 3 weekly Premium Strategy Videos

- Guidance on booking profits and closing positions

Secure your limited-time 30% DISCOUNT here before the deal ends!

|

|

|

|

|

Interested in more insights like these?

This article was originally published on Bravos Research. For more in-depth analysis and exclusive market insights, visit Bravos Research.

Contact us 24/7

Remember, we're here to help. If you have any questions, please contact us.

Warm regards,

The Bravos Research Team |

|

|